TRU NEWS

All disclosure filings, including news releases and financial documents can be found on the TRU Precious Metals SEDAR page.

TRU Publishes Updated NI 43-101 Technical Report for Golden Rose and Commences Fall Exploration Program

TRU Precious Metals Corp. has filed an updated National Instrument 43-101 technical report for its Golden Rose Project in Central Newfoundland to consolidate all of TRU’s exploration and drilling activities completed at Golden Rose since acquiring the Project in early 2021.

Toronto, Ontario – October 11, 2023 – TRU Precious Metals Corp. (TSXV:TRU; OTCQB:TRUIF) (“TRU” or the “Company”) is pleased to announce that it has filed an updated National Instrument 43-101 (“NI 43-101”) technical report (the “Technical Report”) for its Golden Rose Project (“Golden Rose” or the “Project”) in Central Newfoundland. The Technical Report was prepared by APEX Geoscience Ltd. (“APEX”) and Terrane Geoscience Inc. (“Terrane”) and is titled “NI 43-101 Technical Report on the Golden Rose Project, Newfoundland and Labrador, Canada” with an effective date of October 11, 2023. The Technical Report can be found under the Company’s SEDAR+ profile at www.sedarplus.com.

The purpose of the Technical Report is to consolidate all of TRU’s exploration and drilling activities completed at Golden Rose since acquiring the Project in early 2021, including high-grade discoveries of gold, copper, and silver at multiple new targets, and to provide recommendations for future exploration and development of the Project.

Exploration Update

TRU is also pleased to announce it has recently commenced a fall exploration program at Golden Rose, focused on cost-effectively growing its pipeline of gold and critical minerals prospects and producing additional drill-ready targets. The program will include prospecting, grab (rock) sampling, and reconnaissance soil sampling over interpreted precious and base metal anomalies determined through historical data compilation, and recent ground geophysics and remote sensing programs. Many of the planned target areas have had limited exploration to date.

Paul Ténière, TRU’s Vice President of Exploration commented, “We are very pleased to have filed an up-to-date NI 43-101 Technical Report for Golden Rose. This is the culmination of several months of work by our technical team and independent Qualified Persons to compile the extensive exploration and drilling work completed by TRU since 2021. The Technical Report also includes the results from our recent trenching and channel sampling work at Mark’s Pond and prospecting and sampling work targeting new gold and critical minerals targets along the Cape Ray-Valentine Lake Shear Zone. I would like to thank our team, APEX, and Terrane for their meticulous work and continued technical support as we advance the Project. We encourage our mining and capital markets colleagues to review the Technical Report for a deeper dive on the significant discovery potential unfolding at Golden Rose.”

Qualified Person Statement

The scientific and technical information disclosed in this news release has been prepared and approved by Paul Ténière, M.Sc., P.Geo., Vice President of Exploration for TRU, and a Qualified Person as defined in NI 43-101.

Acknowledgement

TRU would like to thank the Government of Newfoundland and Labrador for financial support through the Junior Exploration Assistance Program and the Federal Government for its critical mineral assistance funding for the exploration activities at the Golden Rose Project.

About TRU Precious Metals Corp.

TRU (TSXV:TRU; OTCQB:TRUIF) is on a mission to build long-term shareholder value through prudent natural resource property development and transactions. TRU is exploring for gold and copper in the highly prospective Central Newfoundland Gold Belt on its 100%-owned Golden Rose Project, originally optioned from TSX-listed Altius Minerals. Golden Rose is a regional-scale 264.25 km2 land package, including a recently discovered 20 km district-scale structure, and an additional 45 km of strike length along the deposit-bearing Cape Ray - Valentine Lake Shear Zone, directly between Marathon Gold’s Valentine Gold Project and Matador Mining’s Cape Ray Gold Project. In addition, TRU has an option to acquire up to an aggregate 65% ownership interest in two claim packages covering 33.25 km2 including a 12 km strike length along the Shear Zone within Golden Rose. TRU is approximately 36%-owned by European strategic investor Ormonde Mining plc (AQSE:ORM).

TRU is a portfolio company of Resurgent Capital Corp. (“Resurgent”), a merchant bank providing venture capital markets advisory services and proprietary financing. Resurgent works with promising public and pre-public micro-capitalization companies listing on Canadian stock exchanges. For more information on Resurgent and its portfolio companies, please visit Resurgent’s website at https://www.resurgentcapital.ca/ or follow Resurgent on LinkedIn at https://ca.linkedin.com/company/resurgent-capital-corp.

For further information about TRU, please contact:

Joel Freudman

Co-Founder & CEO

TRU Precious Metals Corp.

Phone: 1-855-760-2TRU (2878)

Email: ir@trupreciousmetals.com

To connect with TRU via social media, below are links:

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This press release contains certain forward-looking statements, including those relating to exploration plans at Golden Rose. These statements are based on numerous assumptions regarding Golden Rose and the Company’s exploration and drilling programs and results that are believed by management to be reasonable in the circumstances, and are subject to a number of risks and uncertainties, including without limitation: mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on Golden Rose; the exploration potential of Golden Rose and the nature and style of mineralization at Golden Rose; risks inherent in mineral exploration activities; volatility in precious metals prices; and those other risks described in the Company’s continuous disclosure documents. Actual results may differ materially from results contemplated by the forward-looking statements herein. Investors and others should carefully consider the foregoing factors and should not place undue reliance on such forward-looking statements. The Company does not undertake to update any forward-looking statements herein except as required by applicable securities laws.

TRU Announces High-Grade Copper and Gold Assays from Summer 2023 Prospecting at Golden Rose, including 7.3% Cu and 54.4 g/t Au

TRU announces high-grade gold and copper results from a recent prospecting and rock (grab) sampling program conducted on the Company’s Golden Rose Project in Central Newfoundland.

Toronto, Ontario – October 3, 2023 – TRU Precious Metals Corp. (TSXV:TRU; OTCQB:TRUIF) (“TRU” or the “Company”) is pleased to announce high-grade gold (Au) and copper (Cu) results from a recent prospecting and rock (grab) sampling program conducted on the Company’s Golden Rose Project (“Golden Rose”) in Central Newfoundland (Figure 1). The summer 2023 prospecting program was focused on the discovery of new gold and critical minerals targets at Golden Rose. These recent high-grade grab sample results continue to prove the rich gold and copper endowment along the highly prospective Cape Ray-Valentine Lake Shear Zones.

Highlights

Three bedrock grab samples collected from the southeastern part of Victoria Lake along the Valentine Lake Shear Zone (“VLSZ”) returned assay values between 0.69 to 2.78 grams per tonne (g/t) Au. This area has had limited exploration to-date.

A newly discovered copper-silver-rich target located less than 2 km north-northeast of the Mark’s Pond target along the Cape Ray Shear Zone (“CRSZ”) returned between 0.53% to 7.33% Cu and 0.9 to 3.3 g/t silver (Ag) from bedrock grab samples. Based on these high-grade copper results, this area is considered a promising critical minerals target for future exploration and may be similar to the Jacob’s Pond target to the west.

Resampling of the Rich House target returned between 2.25 g/t and 54.38 g/t Au and 7.6 g/t Ag in bedrock grab samples, further confirming the high-grade gold and silver present at this target located only 4 km northeast of the Mark’s Pond Gold Zone.

A bedrock grab sample collected approximately 500 m northeast of Wood Lake returned 10.46 g/t Au and a float sample south of Wood Lake returned 9.66 g/t Au.

Significant assay highlights from the grab sampling program are shown in Table 1 and Figure 2 below.

TRU Co-Founder and CEO Joel Freudman commented: “These recent grab sample assay results are encouraging, especially in areas that have not seen much, if any, exploration in the past. We are quite excited about the critical minerals and gold potential in the northeastern part of Golden Rose along the Cape Ray Shear Zone and in the southeastern part of Victoria Lake, and these areas warrant future early-stage exploration at Golden Rose. Our immediate plan is to continue to grow our pipeline of gold and critical minerals prospects at Golden Rose using innovative and cost-effective exploration, geophysical, and remote sensing techniques to produce several additional drill-ready targets beyond what we are already firming up at Mark’s Pond.”

Figure 1: Golden Rose Project Location Map

Figure 2: Assay highlights from the summer 2023 prospecting and grab sampling program at Golden Rose

Table 1: Table of assay highlights from the summer 2023 grab sampling program

Notes: *Samples returning fire assay results >1 g/t Au were analysed using Total Pulp Metallic analysis (screen metallics) to mitigate the nugget effect of coarse visible gold in the samples. NSV - no significant values; CRSZ – Cape Ray Shear Zone; VLSZ – Valentine Lake Shear Zone.

Technical Summary

TRU recently completed its summer 2023 exploration program and collected a number of rock (grab) samples from the Rich House target and Wood Lake area, and at several locations along the Cape Ray-Valentine Lake Shear Zone with minimal to no historical exploration work. Assay highlights from the grab sampling program are shown in Figure 2 and Table 1.

Grab samples collected at Rich House included green-grey to brown altered (quartz-ankerite alteration) metasediments with stockwork quartz veins/veinlets and visible gold, and trace arsenopyrite. Grab samples collected at Wood Lake included fine-grained, green-grey mafic volcanics and pink monzogranite with between 3-5% disseminated pyrite, 1-2% chalcopyrite, and 3% arsenopyrite. Grab samples collected along the CRSZ in the northwestern part of Golden Rose included dark grey to green, strongly chloritized and sheared mafic volcanics with abundant chalcopyrite (3 to >5%), pyrite (2-3%), and minor malachite producing high-grade copper results. Grab samples collected on the southeastern part of Victoria Lake along the VLSZ included medium-grained, green-grey mafic volcanics with abundant pyrite and chalcopyrite and rusty weathered surfaces.

Certain of the Company’s claims at Golden Rose are under option from Quadro Resources Ltd. (the “Optionor”) pursuant to an option agreement between the parties. Under such agreement, the Optionor will retain either a 49% interest or a 35% interest, as the case may be, in such claims depending on the extent, if any, to which TRU exercises its option.

Sampling, QAQC, and Analytical Procedures

All rock (grab) samples were either collected from outcrops (bedrock) or as float samples and put into sample bags with unique sample tags by TRU prospecting and geological staff. The exact location of the collected grab sample was taken using a handheld GPS unit and field notes were taken on lithology, structure, and mineralization. The grab samples were securely transported by TRU staff to either Eastern Analytical’s laboratory in Springdale, NL or SGS Canada’s laboratory in Grand Falls-Windsor, NL. Eastern Analytical and SGS Canada are commercial laboratories that are ISO/IEC 17025 accredited and both independent of TRU. Both laboratories pulverized 1,000 grams of each sample to 95% < 89 μm. Samples were analyzed using fire assay (30g) with AA finish and an ICP-34, four acid digestion followed by ICP-OES analysis. Samples sent to the lab with visible gold or assaying above 1.00 g/t Au were further assayed using Total Pulp Metallic analysis (metallic screening) to mitigate the presence of the nugget effect of coarse gold.

Total Pulp Metallic Sieve Procedure: Crush entire sample to approximately 80% (-10 mesh). Total sample is pulverized to approximately 95% (-150 mesh) in 200-300g portions. Sieve all pulverized material through 150 mesh screen. The total (+150 mesh) fraction is all fire assayed as one sample and the weight recorded. The entire (-150 mesh) fraction is rolled to homogenize and stored in a plastic bag. The entire weight of the (-150 mesh) fraction is recorded. A 30g sample is fire assayed from the (-150 mesh) portion. The two fire assay results (+150 and -150 mesh) are calculated (with the total weight of the sample to provide a weighted average of the sample) and the weighted average Au result is reported.

The TRU exploration programs are designed to be consistent with mining industry best practices and the programs are supervised by Qualified Persons employing a QAQC program consistent with requirements under the CIM Mineral Exploration Best Practice Guidelines (2018) and National Instrument 43-101 (“NI 43-101”).

Cautionary Statements

Please note that soil, till, rock, and float samples are selective by nature, and values reported may not represent the true grade or style of mineralization at Golden Rose. Readers are cautioned that these potential grades are conceptual in nature; there has been insufficient exploration by the Company or its Qualified Person to define a mineral resource or deposit; and it is uncertain whether further exploration will result in these targets being delineated as a mineral resource.

The reader is cautioned that descriptions of mineralization reported in this news release are preliminary and/or early-stage results. While these results are considered encouraging, there is no guarantee that they indicate significant mineralization will be intersected in future drilling programs completed by the Company.

Qualified Person Statement and Data Verification

The scientific and technical information disclosed in this news release has been prepared and approved by Paul Ténière, M.Sc., P.Geo., Vice President of Exploration for TRU, and a Qualified Person as defined in NI 43-101.

Mr. Ténière has verified all scientific and technical data disclosed in this news release including the grab sampling results and certified analytical data underlying the technical information disclosed. Mr. Ténière noted no errors or omissions during the data verification process and TRU’s Exploration Manager has also verified the information disclosed. The Company and Mr. Ténière do not recognize any factors of sampling or recovery that could materially affect the accuracy or reliability of the assay data disclosed in this news release.

Acknowledgement

TRU would like to thank the Government of Newfoundland and Labrador for financial support through the Junior Exploration Assistance Program and the Federal Government for its critical mineral assistance funding for the exploration activities at the Golden Rose Project.

About TRU Precious Metals Corp.

TRU (TSXV:TRU; OTCQB:TRUIF) is on a mission to build long-term shareholder value through prudent natural resource property development and transactions. TRU is exploring for gold and copper in the highly prospective Central Newfoundland Gold Belt on its 100%-owned Golden Rose Project, originally optioned from TSX-listed Altius Minerals. Golden Rose is a regional-scale 264.25 km2 land package, including a recently discovered 20 km district-scale structure, and an additional 45 km of strike length along the deposit-bearing Cape Ray - Valentine Lake Shear Zone, directly between Marathon Gold’s Valentine Gold Project and Matador Mining’s Cape Ray Gold Project. In addition, TRU has an option with Quadro Resources Ltd. to acquire up to an aggregate 65% ownership interest in two claim packages covering 33.25 km2 including a 12 km strike length along the Shear Zone within Golden Rose. TRU is approximately 36%-owned by European strategic investor Ormonde Mining plc (AQSE:ORM).

TRU is a portfolio company of Resurgent Capital Corp. (“Resurgent”), a merchant bank providing venture capital markets advisory services and proprietary financing. Resurgent works with promising public and pre-public micro-capitalization companies listing on Canadian stock exchanges. For more information on Resurgent and its portfolio companies, please visit Resurgent’s website at https://www.resurgentcapital.ca/ or follow Resurgent on LinkedIn at https://ca.linkedin.com/company/resurgent-capital-corp.

For further information about TRU, please contact:

Joel Freudman

Co-Founder & CEO

TRU Precious Metals Corp.

Phone: 1-855-760-2TRU (2878)

Email: ir@trupreciousmetals.com

To connect with TRU via social media, below are links:

Acknowledgement

TRU would like to thank the Government of Newfoundland and Labrador for financial support through the Junior Exploration Assistance Program and the Federal Government for its critical mineral assistance funding for the exploration activities at the Golden Rose Project.

Forward-Looking Statements

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This press release contains certain forward-looking statements, including those relating to exploration plans and mineralization potential at Golden Rose, and to potential transactions with Twilite. These statements are based on numerous assumptions regarding Golden Rose and the Company’s exploration programs and results that are believed by management to be reasonable in the circumstances, and are subject to a number of risks and uncertainties, including without limitation: the exploration potential of Golden Rose and the nature and style of mineralization at Golden Rose; mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on Golden Rose; risks inherent in mineral exploration activities; volatility in precious metals prices; challenges in sourcing and executing property transactions; and those other risks described in the Company’s continuous disclosure documents. Actual results may differ materially from results contemplated by the forward-looking statements herein. Investors and others should carefully consider the foregoing factors and should not place undue reliance on such forward-looking statements. The Company does not undertake to update any forward-looking statements herein except as required by applicable securities laws.

TRU Extends High-Grade Gold Channel Sampling Results at Golden Rose, Including 14.6 g/t Au over 0.5 m and 5.7 g/t Au over 0.5 m

TRU Precious Metals Corp. reports additional high-grade gold channel sampling assay results from its summer 2023 trenching program at its Golden Rose Project, at the Mark’s Pond target on mineral claims under option from Quadro Resources Ltd.

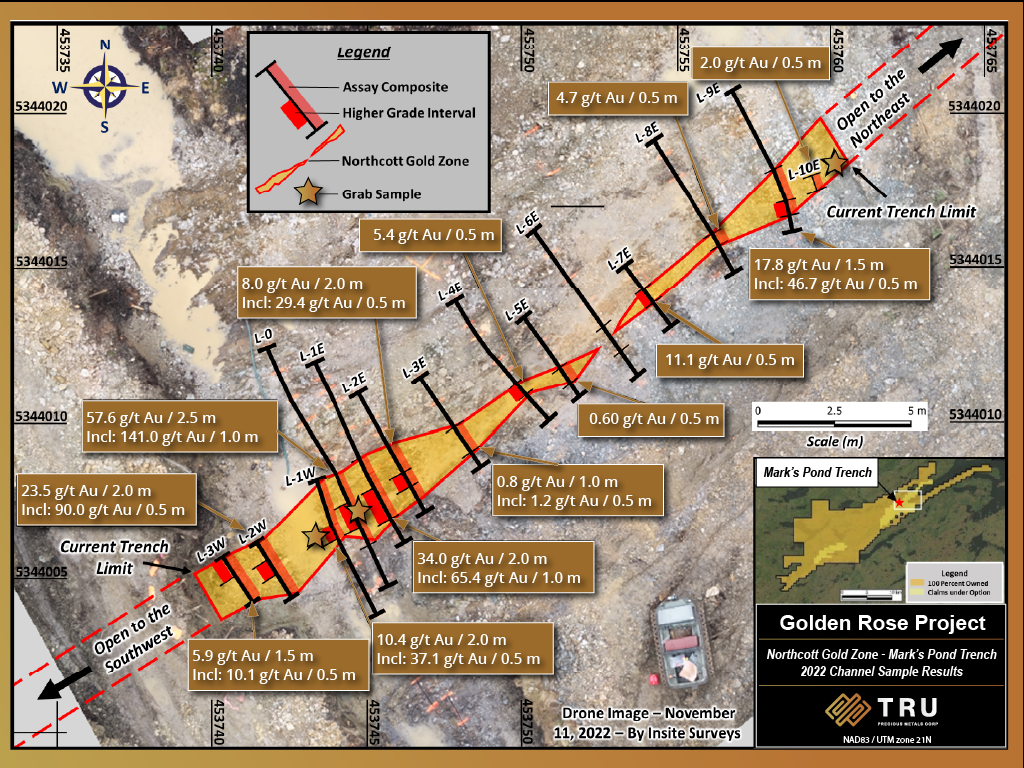

Toronto, Ontario – September 19, 2023 – TRU Precious Metals Corp. (TSXV:TRU; OTCQB:TRUIF) (“TRU” or the “Company”) is pleased to report additional high-grade gold channel sampling assay results from its summer 2023 trenching program at its Golden Rose Project (“Golden Rose”), at the Mark’s Pond target on mineral claims under option from Quadro Resources Ltd. (Figure 1). The 2023 trenching and channel sampling program is a continuation of the trenching program that commenced in fall 2022 at Mark’s Pond and led to the discovery of the Northcott Gold Zone (see press release dated January 12, 2023).

Highlights

The 2023 channel sampling program includes high-grade gold results from the Northcott West Extension trench, including:

14.58 grams per tonne (g/t) of gold (Au) over 0.5 metres (m), 5.73 g/t Au over 0.5 m, 4.05 g/t Au over 0.5 m, and

2.92 g/t Au over 1.1 m including 3.76 g/t Au over 0.6 m.

Channel samples were collected at 0.5 to 1 m intervals within each trench and included QAQC protocols. Samples returning fire assay results >1 g/t Au also underwent total pulp metallics analysis (screen metallics) to mitigate the presence of the nugget effect of coarse gold. Significant channel assay results are shown in Table 1.

The Northcott Gold Zone still remains open along strike to the southwest and northeast and has now been mapped over a 240 m strike length through trenching. TRU plans to continue mapping, prospecting, and infill soil sampling surveys along the contact between the Rogerson Lake Conglomerate and mafic volcanics to identify additional mineralized zones. A drilling plan is also being developed for the Northcott Gold Zone to confirm gold mineralization at depth.

Paul Ténière, TRU’s Vice President of Exploration commented, “These recent channel sample results have confirmed that gold mineralization in the Northcott Gold Zone extends along strike to the southwest at least 145 metres from the main Northcott trench and still remains open to the southwest and northeast. Our immediate plan is to further define this highly mineralized lithological contact to identify additional high-grade mineralized shoots along strike and to generate several drill targets in the Mark’s Pond area.”

TRU collected approximately 400 channel samples from the main Northcott trench, and five additional trenches excavated to the northeast and southwest of the main Northcott trench (Figure 2). This includes the Northcott West Extension trench, which has exposed a further 25 m of the high-grade Northcott Gold Zone along strike to the southwest. Detailed mapping in the Northcott West Extension trench indicates the Northcott Gold Zone is approximately 3-6 m wide at surface, has a known strike length of at least 60 m, and is still open to the northeast and southwest (Figure 3). The high-grade gold mineralization within the Northcott East and West extension trenches is being interpreted as a highly mineralized shoot, the plunge and thickness of which still needs to be confirmed through drilling.

The trenches were also structurally mapped by Terrane Geoscience (“Terrane”) in late May 2023. Terrane concluded that the high-grade gold mineralization in the Northcott Gold Zone is mainly concentrated at the faulted, brittle-ductile deformed contact between the Rogerson Lake conglomerate and mafic volcanic units as the latter rocks are more competent allowing veining and mineralization to occur. Terrane recommended targeting this faulted contact along strike to identify additional gold zones, and drill testing the Northcott Gold Zone at an azimuth to the northwest (normal to the lithological contact) to confirm gold mineralization at depth.

Figure 1: Golden Rose Project Location and Ownership Map

Figure 2: 2022 and 2023 significant channel assay highlights from trenching in the Northcott Gold Zone

Figure 3: Significant channel assay highlights from the Northcott West Extension trench

Table 1: Northcott Gold Zone - 2023 significant channel assay results

Notes:

(1) Refer to Figures 2 and 3 for channel sample locations.

(2) Assay results shown above include both fire assay (FAA) and metallic screening analysis (FSM) results.

(3) Numbers have been rounded.

(4) True width of Northcott Gold Zone is currently unknown.

Technical Summary

The Northcott Gold Zone trenches are located approximately 130 m northwest of the historically drilled, gold-bearing Mark’s Pond Gold Zone. A high-resolution drone (UAV) imagery survey was completed by Insite Surveys of Burgeo, NL over all the trenches capturing the channel sampling locations in precise detail. The drone imagery has been georeferenced for structural mapping purposes and to precisely locate the channel samples for future geological modelling and resource estimation. The true width of the Northcott Gold Zone is unknown at this time. However, the rock units are subvertical indicating sampled widths are likely close to true width, and this will be confirmed during future drilling.

The channel sample assay results continue to indicate that the quartz-carbonate veins and mineralized gold intervals within the Northcott Gold Zone tend to pinch and swell along strike, with high-grade widths ranging between 0.4 to 2.5 m (Figures 2 and 3). Associated alteration includes widespread sericite alteration within the highly strained fault zone and narrow zones of ankerite and chlorite alteration localized to the contact between the Rogerson Lake Conglomerate and mafic volcanic units. As noted earlier, gold mineralization remains open to the southwest and northeast of the current trench limits. TRU plans to continue mapping and prospecting of the mineralized contact between the Rogerson Lake Conglomerate and mafic volcanics to better understand the structural controls on gold mineralization in the Mark’s Pond target area.

The Mark’s Pond target area is among the Company’s claims under option from Quadro Resources Ltd. (the “Optionor”) pursuant to an option agreement between the parties. Under such agreement, the Optionor will retain either a 49% interest or a 35% interest, as the case may be, in such claims depending on the extent, if any, to which TRU exercises its option.

Sampling, QAQC, and Analytical Procedures

All channel samples were cut using portable saws with diamond blades and cleaned thoroughly with fresh water prior to insertion into sample bags by TRU field staff. This trench and sample cleaning process was implemented to eliminate the possibility of sample contamination from overburden (soil and till). The exact location of the channel sample line was taken using a handheld GPS unit and indicated on a hand drawn trench map, and field notes were taken on lithology, structure, and mineralization. The exact locations of the channel samples were later correlated and georeferenced with the high precision drone survey imagery. The channel sampling program included the insertion of QAQC materials (certified reference materials, blanks, and field duplicates) into the sample stream at regular intervals by TRU geologists.

The channel samples were securely transported by TRU field staff to Eastern Analytical Ltd. (“Eastern Analytical”), a commercial laboratory that is ISO/IEC 17025 accredited and independent of TRU. Eastern Analytical pulverized 1,000 grams of each sample to 95% < 89 μm. Samples are analyzed using fire assay (30g) with AA finish and an ICP-34, four acid digestion followed by ICP-OES analysis. All samples with visible gold or assaying above 1.00 g/t Au were further assayed using total pulp metallic analysis (metallic screening) to mitigate the presence of the nugget effect of coarse gold.

Eastern Analytical total pulp metallic sieve procedure: Crush entire sample to approximately 80% (-10 mesh). Total sample is pulverized to approximately 95% (-150 mesh) in 200-300g portions. Sieve all pulverized material through 150 mesh screen. The total (+150 mesh) fraction is all fire assayed as one sample and the weight recorded. The entire (-150 mesh) fraction is rolled to homogenize and stored in a plastic bag. The entire weight of the (-150 mesh) fraction is recorded. A 30g sample is fire assayed from the (-150 mesh) portion. The two fire assay results (+150 and -150 mesh) are calculated (with the total weight of the sample to provide a weighted average of the sample) and the weighted average Au result is reported.

The TRU exploration programs are designed to be consistent with mining industry best practices and the programs are supervised by Qualified Persons employing a full QAQC program consistent with requirements under the CIM Mineral Exploration Best Practice Guidelines (2018) and National Instrument 43-101 (“NI 43-101”).

Readers are cautioned that descriptions of mineralization and the channel sample assay results reported in this news release are preliminary and/or early-stage results. While these results are considered encouraging, there is no guarantee that they indicate significant mineralization will be intersected at depth in future drilling.

Qualified Person Statement and Data Verification

The scientific and technical information disclosed in this news release has been prepared and approved by Paul Ténière, M.Sc., P.Geo., Vice President of Exploration for TRU, and a Qualified Person as defined in NI 43-101.

Mr. Ténière has verified all scientific and technical data disclosed in this news release including the channel sampling and QAQC results, and certified analytical data underlying the technical information disclosed. Mr. Ténière noted no errors or omissions during the data verification process and TRU’s Exploration Manager has also verified the information disclosed. The Company and Mr. Ténière do not recognize any factors of sampling or recovery that could materially affect the accuracy or reliability of the assay data disclosed in this news release.

About TRU Precious Metals Corp.

TRU (TSXV:TRU; OTCQB:TRUIF) is on a mission to build long-term shareholder value through prudent natural resource property development and transactions. TRU is exploring for gold and copper in the highly prospective Central Newfoundland Gold Belt on its 100%-owned Golden Rose Project, originally optioned from TSX-listed Altius Minerals. Golden Rose is a regional-scale 264.25 km2 land package, including a recently-discovered 20 km district-scale structure, and an additional 45 km of strike length along the deposit-bearing Cape Ray - Valentine Lake Shear Zone, directly between Marathon Gold’s Valentine Gold Project and Matador Mining’s Cape Ray Gold Project. In addition, TRU has an option with Quadro Resources Ltd. to acquire up to an aggregate 65% ownership interest in two claim packages covering 33.25 km2 including a 12 km strike length along the Shear Zone within Golden Rose.

TRU is a portfolio company of Resurgent Capital Corp. (“Resurgent”), a merchant bank providing venture capital markets advisory services and proprietary financing. Resurgent works with promising public and pre-public micro-capitalization companies listing on Canadian stock exchanges. For more information on Resurgent and its portfolio companies, please visit Resurgent’s website at https://www.resurgentcapital.ca or follow Resurgent on LinkedIn at https://ca.linkedin.com/company/resurgent-capital-corp.

For further information about TRU, please contact:

Joel Freudman

Co-Founder & CEO

TRU Precious Metals Corp.

Phone: 1-855-760-2TRU (2878)

Email: ir@trupreciousmetals.com

To connect with TRU via social media, below are links:

Acknowledgement

TRU would like to thank the Government of Newfoundland and Labrador for financial support through the Junior Exploration Assistance Program and the Federal Government for its critical mineral assistance funding for the exploration activities at the Golden Rose Project.

Forward-Looking Statements

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This press release contains certain forward-looking statements, including those relating to exploration plans and mineralization potential at Golden Rose, and to potential transactions with Twilite. These statements are based on numerous assumptions regarding Golden Rose and the Company’s exploration programs and results that are believed by management to be reasonable in the circumstances, and are subject to a number of risks and uncertainties, including without limitation: the exploration potential of Golden Rose and the nature and style of mineralization at Golden Rose; mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on Golden Rose; risks inherent in mineral exploration activities; volatility in precious metals prices; challenges in sourcing and executing property transactions; and those other risks described in the Company’s continuous disclosure documents. Actual results may differ materially from results contemplated by the forward-looking statements herein. Investors and others should carefully consider the foregoing factors and should not place undue reliance on such forward-looking statements. The Company does not undertake to update any forward-looking statements herein except as required by applicable securities laws.

TRU Closes CAD$3 Million Strategic Investment from Ormonde Mining Plc

TRU Precious Metals Corp. has closed the CAD$3,000,000 non-brokered private placement, with a wholly-owned subsidiary of Ormonde Mining Plc, that was previously announced on July 4, 2023.

THIS NEWS RELEASE IS NOT INTENDED FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

Toronto, Ontario – September 6, 2023 – TRU Precious Metals Corp. (TSXV:TRU) (“TRU” or the “Company”) is pleased to announce that it has closed the CAD$3,000,000 non-brokered private placement (the “Offering”), with a wholly-owned subsidiary of Ormonde Mining Plc (“Ormonde”) [(LON:ORM)], that was previously announced on July 4, 2023. The Company issued a total of 60,000,000 units (“Units”) at a price of CAD$0.05 per Unit, with each Unit being comprised of one common share of the Company (each, a “Common Share”) and 0.5 of one Common Share purchase warrant (each whole warrant, a “Warrant”). Each Warrant is exercisable to acquire one Common Share at a price of CAD$0.075 for a period of 36 months.

Joel Freudman, Co-Founder and CEO of TRU, commented: “Closing this Offering marks a game-changing inflection point for TRU. We’re delighted to welcome Ormonde not only as a strategic investor, but also as our largest stakeholder. Ormonde’s entrance into the North American resource space through TRU speaks to the intrinsic value of our Golden Rose Project, as well as the caliber of the TRU team. In addition to advancing our Golden Rose Project, the funds from the Offering will enable us to execute a number of strategic and corporate initiatives we’ve been evaluating to generate value and ultimately drive share price appreciation. TRU is now well-capitalized amidst otherwise difficult market conditions, which we expect will lead to numerous exciting opportunities ahead. We look forward to combining the extensive technical expertise, capital markets knowledge, and transactional experience of our Ormonde partners with our own bench strength, as we lay the groundwork to pursue and achieve our overarching mission: to build long-term shareholder value, through prudent natural resource property development and transactions.”

Ormonde is a natural resources company focused on evaluating and executing new opportunities in the mineral exploration sector, through which they can leverage their existing balance sheet to create shareholder value. Ormonde is run by a seasoned team with a wide range of experience in natural resources including base and precious metals, investment banking and advisory services, and senior advisory roles. Ormonde has a proven track record in the successful acquisition and sale of natural resource assets, including its most recent transaction, the sale of the La Zarza gold, copper and zinc deposit property located in the Iberian Pyrite Belt in Spain.

In connection with the closing of the Offering, Ormonde has the right to appoint three out of five of the Company’s board of directors (the “Board”), with each such appointee subject to TSX Venture Exchange approval. As such, in addition to Brian Timmons who joined the Board on June 30, 2023, Steve Nicol has been appointed to the Board as Ormonde’s second nominee. The final Ormonde Board nominee is expected to be appointed and announced shortly.

Mr. Nicol is a mining engineer with over 35 years of experience in the mining industry, including operations management, mine evaluation and development, and other diverse corporate roles. His experience covers open pit and underground mining, CIL, flotation, and gravity processing, and direct hands-on management of all phases of diverse mining projects, from early-stage exploration through to mine closure and rehabilitation, for a variety of commodities including base, precious and specialty metals and diamonds.

To accommodate Mr. Nicol joining the Board, David Hladky has resigned as a director of TRU. Mr. Freudman added: “We thank Dave for his valuable contributions as a director to the Company since 2020. On behalf of the Board and management, I wish him the very best with his future endeavours and look forward to his continued support as a shareholder. We also take this opportunity to welcome Steve Nicol to our Board, and expect he’ll provide tremendous insights to TRU as he applies his mineral project development acumen to our advancement of the Golden Rose Project.”

The securities issued under the Offering have not been, and will not be, registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”) or any U.S. state securities laws and may not be offered or sold in the United States absent registration or an available exemption from the registration requirement of the U.S. Securities Act and applicable U.S. state securities laws. This press release shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of, such securities in any jurisdiction in which such offer, solicitation or sale would be unlawful.

Pursuant to the Offering, Ormonde acquired 60,000,000 Common Shares and 30,000,000 Warrants. Prior to the completion of the Offering, Ormonde did not hold any securities of the Company. As at the date hereof, after giving effect to the Offering, Ormonde holds 60,000,000 Common Shares representing approximately 36.19% of the Company’s issued and outstanding Common Shares, or 45.97% of the Common Shares on a partially diluted basis if Ormonde were to exercise all the Warrants that have been issued to it under the Offering. The Common Shares acquired by Ormonde pursuant to the Offering were acquired for investment purposes. Depending on market and other conditions, or as future circumstances may dictate, Ormonde may from time to time, increase or decrease its holdings of the Company's Common Shares. This portion of this news release is issued pursuant to National Instrument 62-103 – The Early Warning System and Related Take-Over Bid and Insider Reporting Issues, which also requires an early warning report to be filed with the applicable securities regulators containing additional information with respect to the foregoing matters. A copy of the early warning report of Ormonde will be available on TRU’s issuer profile on SEDAR+ at www.sedarplus.ca.

Non-Core Property Optimization Updates

TRU and Eastern Precious Metals Corp. (“Eastern”) have mutually agreed to terminate the Option Agreement on the Company’s Twilite Gold Project (“Twilite”) (see press release dated August 16, 2022). TRU has surrendered its special warrants to acquire Eastern shares, but retains 100% ownership of Twilite, a gold-bearing, drill-ready property located along the deposit-bearing Cape Ray-Valentine Lake Shear Zone, and for which Eastern has funded and completed a NI 43-101 Technical Report. TRU will be actively pursuing alternative transactions with the property.

Additionally, the Company has allowed its mineral license for the Gander West Property to lapse.

About TRU Precious Metals Corp.

TRU (TSXV:TRU; OTCQB:TRUIF) is on a mission to build long-term shareholder value, through prudent natural resource property development and transactions. TRU is exploring for gold and copper in the highly prospective Central Newfoundland Gold Belt on its 100%-owned Golden Rose Project, originally optioned from TSX-listed Altius Minerals. Golden Rose is a regional-scale 240.25 km2 land package, including a recently-discovered 20 km district-scale structure, and an additional 45 km of strike length along the deposit-bearing Cape Ray - Valentine Lake Shear Zone, directly between Marathon Gold’s Valentine Gold Project and Matador Mining’s Cape Ray Gold Project. In addition, TRU has an option to acquire up to an aggregate 65% ownership interest in two claim packages covering 33.25 km2 including a 12 km strike length along the Shear Zone within Golden Rose.

TRU is a portfolio company of Resurgent Capital Corp. (“Resurgent”), a merchant bank providing venture capital markets advisory services and proprietary financing. Resurgent works with promising public and pre-public micro-capitalization companies listing on Canadian stock exchanges. For more information on Resurgent and its portfolio companies, please visit Resurgent’s website at https://www.resurgentcapital.ca/ or follow Resurgent on LinkedIn at https://ca.linkedin.com/company/resurgent-capital-corp.

For further information about TRU, please contact:

Joel Freudman

Co-Founder & CEO

TRU Precious Metals Corp.

Phone: 1-855-760-2TRU (2878)

Email: ir@trupreciousmetals.com

To connect with TRU via social media, below are links:

Acknowledgement

TRU would like to thank the Government of Newfoundland and Labrador for financial support through the Junior Exploration Assistance Program and the Federal Government for its critical mineral assistance funding for the exploration activities at the Golden Rose Project.

Forward-Looking Information

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This press release contains certain forward-looking statements relating to, among other things, the Company’s future strategic and corporate initiatives and their expected outcomes; the appointment of additional directors; and the Company’s plans for its Golden Rose Project. These statements are based on numerous assumptions and the Company’s plans that are believed by management to be reasonable in the circumstances, and are subject to a number of risks and uncertainties, including without limitation: risks related to the ability of the Company to use the Offering proceeds as intended; risks inherent in mineral exploration activities; mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company’s properties; transaction execution risk; volatility in financial markets, economic conditions, and precious and base metals prices; and those other risks described in the Company’s continuous disclosure documents. Actual results may differ materially from results contemplated by the forward-looking statements herein. Investors and others should carefully consider the foregoing factors and should not place undue reliance on such forward-looking statements. The Company does not undertake to update any forward-looking statements herein except as required by applicable securities laws.

TRU Announces Voting Results of Annual and Special Meeting of Shareholders

TRU Precious Metals Corp. is pleased to announce the results of its Annual and Special meeting of shareholders held on July 31, 2023.

Toronto, Ontario – August 1, 2023 – TRU Precious Metals Corp. (TSXV:TRU; OTCQB:TRUIF) (“TRU” or the “Company”) is pleased to announce the results of its Annual and Special meeting of shareholders (the “Meeting”) held on July 31, 2023.

The Company’s shareholders voted overwhelmingly in favour of all matters brought before the Meeting. All of the director nominees set out in the Company’s Information Circular dated June 29, 2023, namely Joel Freudman, Manish Kshatriya, Brian Timmons and David Hladky, were elected to serve until the next meeting of shareholders.

The Company’s shareholders also approved the following resolutions: (i) reappointment of McGovern Hurley LLP, Chartered Professional Accountants, as auditors of the Company; (ii) Company’s amended stock option plan; (iii) potential corporate name change; (iv) potential voluntary delisting of the Company’s common shares (the “Shares”) from the TSX Venture Exchange (“TSXV”); (v) potential consolidation of the Shares; and (vi) creation of a new “Control Person” under TSXV policies, in connection with the Company’s proposed CAD$3,000,000 strategic investment (the “Investment”) from Ormonde Mining plc (see July 4, 2023 press release).

TRU currently expects that the Investment will be completed on or about September 5, 2023.

Separately, the Company is also reporting that it has entered into a Geological Services Agreement with Lynx Resources Corp. (“Lynx”), an arm’s length company, whereby TRU will provide exploration and geological services for Lynx’s Turner’s Ridge Property in Newfoundland, Canada. This arrangement is expected to generate revenues and cash flow for TRU.

About TRU Precious Metals Corp.

TRU (TSXV:TRU; OTCQB:TRUIF) is on a mission to build long-term shareholder value, through prudent natural resource property development and transactions. TRU is exploring for gold and copper in the highly prospective Central Newfoundland Gold Belt on its 100%-owned Golden Rose Project, originally optioned from TSX-listed Altius Minerals. Golden Rose is a regional-scale 240.25 km2 land package, including a recently-discovered 20 km district-scale structure, and an additional 45 km of strike length along the deposit-bearing Cape Ray - Valentine Lake Shear Zone, directly between Marathon Gold’s Valentine Gold Project and Matador Mining’s Cape Ray Gold Project. In addition, TRU has an option to acquire up to an aggregate 65% ownership interest in two claim packages covering 33.25 km2 including a 12 km strike length along the Shear Zone within Golden Rose.

TRU is a portfolio company of Resurgent Capital Corp. (“Resurgent”), a merchant bank providing venture capital markets advisory services and proprietary financing. Resurgent works with promising public and pre-public micro-capitalization companies listing on Canadian stock exchanges. For more information on Resurgent and its portfolio companies, please visit Resurgent’s website at https://www.resurgentcapital.ca/ or follow Resurgent on LinkedIn at https://ca.linkedin.com/company/resurgent-capital-corp.

For further information about TRU, please contact:

Joel Freudman

Co-Founder & CEO

TRU Precious Metals Corp.

Phone: 1-855-760-2TRU (2878)

Email: ir@trupreciousmetals.com

To connect with TRU via social media, below are links:

Acknowledgement

TRU would like to thank the Government of Newfoundland and Labrador for financial support through the Junior Exploration Assistance Program and the Federal Government for its critical mineral assistance funding for the exploration activities at the Golden Rose Project.

Forward-Looking Statements

Cautionary Statements Regarding Forward-Looking Information

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This press release contains certain forward-looking statements, including those relating to potential corporate actions that may be taken by TRU, to timing of completion of the Investment, and regarding future financial impacts of the Lynx contract. These statements are based on numerous assumptions believed by management to be reasonable in the circumstances, and based on management’s current plans, and are subject to a number of risks and uncertainties, including without limitation: challenges executing on corporate strategy and business plans; regulatory approval processes; and those other risks described in the Company’s continuous disclosure documents. Actual results may differ materially from results contemplated by the forward-looking statements herein. Investors and others should carefully consider the foregoing factors and should not place undue reliance on such forward-looking statements. The Company does not undertake to update any forward-looking statements herein except as required by applicable securities laws.

TRU Announces Proposed CAD$3 Million Strategic Investment from Ormonde Mining Plc

TRU Precious Metals Corp. is pleased to announce that it has entered into a binding subscription agreement with Ormonde Mining Plc, with respect to a non-brokered private placement of the Company to be carried out by a wholly-owned subsidiary of Ormonde for gross proceeds of CAD$3,000,000.

THIS NEWS RELEASE IS NOT INTENDED FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

Toronto, Ontario – July 4, 2023 – TRU Precious Metals Corp. (TSXV:TRU; OTCQB:TRUIF) (“TRU” or the “Company”) is pleased to announce that it has entered into a binding subscription agreement (the “Agreement”) with Ormonde Mining Plc (“Ormonde”) (LON:ORM), with respect to a non-brokered private placement of the Company to be carried out by a wholly-owned subsidiary of Ormonde for gross proceeds of CAD$3,000,000 (the “Offering”). Pursuant to the Offering, the Company will issue a total of 60,000,000 units (“Units”) at a price of CAD$0.05 per Unit, with each Unit being comprised of one common share of the Company (each, a “Common Share”) and 0.5 of one Common Share purchase warrant (each whole warrant, a “Warrant”). Each Warrant would be exercisable to acquire one Common Share at a price of CAD$0.075 for a period of 36 months following the closing date of the Offering.

Completion of the Offering is subject to Ormonde obtaining shareholder approval and delisting from both the LSE Alternative Investment Market (“AIM”) and Euronext Growth, and subsequently to Ormonde completing such delisting. Completion of the Offering is also subject to the Company obtaining shareholder and TSX Venture Exchange approval, as discussed below.

Joel Freudman, Co-Founder and Chief Executive Officer of TRU, commented: “On behalf of TRU management and our board of directors, we’re very excited to work with Ormonde towards them becoming a significant stakeholder of the Company. Their intended investment in TRU, which would mark Ormonde’s first foray into mineral exploration in North America, validates that TRU is significantly undervalued at current share price levels, and cements us on the right path to value-creation ahead. Both parties are extremely committed to successfully completing the Offering. We’re confident Ormonde will become an increasingly important partner of TRU, as we draw on their extensive technical expertise, successful transactional experience in the resource sector, and general capital markets savvy as we continue our efforts to develop our Golden Rose Project in central Newfoundland.”

Ormonde is a natural resources company listed on AIM and on the Euronext Growth market in Dublin. Headquartered in Ireland, Ormonde is focused on evaluating and executing new opportunities in the mineral exploration sector, through which they can leverage their existing balance sheet to create shareholder value. Ormonde is run by a seasoned team with a wide range of experience in natural resources including base and precious metals, investment banking and advisory services, and senior advisory roles. Ormonde has a proven track record in the successful acquisition and sale of natural resource assets, including its most recent transaction, the sale of the La Zarza gold, copper and zinc deposit property located in the Iberian Pyrite Belt in Spain.

Upon completion of the Offering, and assuming no other share issuances by TRU, Ormonde would own approximately 36.19% of the Company’s issued and outstanding Common Shares, or 45.97% of the Common Shares on a partially-diluted basis if Ormonde were to exercise all the Warrants that would be issued to it under the Offering.

In connection with the Offering, and provided Ormonde would hold greater than 33% of the issued and outstanding Common Shares, (a) Ormonde would have the right to appoint three out of five nominees to the board of directors of the Company (the “Board”) (subject to TSX Venture Exchange approval), and (b) management of the Company would nominate the Ormonde nominees for election as directors of the Company at each annual meeting of shareholders held following closing and the Company would be required to use its best efforts (subject to fiduciary obligations) to ensure that that nominees are elected as directors.

As a further demonstration of the parties’ commitment to completing the Offering, the Company has appointed Brian Timmons, the Chairman of the board of directors of Ormonde, to the Board. Mr. Timmons has over 30 years of experience in senior positions within financial institutions and a range of companies across the corporate sector including companies operating in the alternative energy, natural resource, healthcare technology, bioscience and software IT sectors. He is a Fellow of the Association of Chartered Certified Accountants.

To accommodate Mr. Timmons joining the Board, Barry Greene has resigned as a director of TRU. Mr. Freudman added: “On behalf of the entire TRU team, we sincerely thank Barry for his longstanding service to the Company since its developmental days in late 2020, first as our inaugural Vice-President of Property Development, and more recently as Chair of the Technical Committee of the Board. We wish Barry much success in his future endeavours. We also take this opportunity to welcome Brian Timmons to our Board, and look forward to his governance and transactional advice.”

The proceeds from the Offering will be used for the development of the Company’s Golden Rose Project, as well as for general corporate and working capital purposes. No finder’s fees or commissions will be paid in connection with the Offering.

Given that, following the completion of the Offering, Ormonde will have a right to appoint a majority of the directors to the board of directors of the Company, and will hold greater than 20% of the outstanding Common Shares, the Offering will require shareholder approval pursuant to the applicable policies of the TSX Venture Exchange, as Ormonde will be deemed to be a new “Control Person” of the Company. The Company has called an annual and special meeting of shareholders of the Company, which will be held on July 31, 2023, for (among other things) the purpose of obtaining the requisite shareholder approvals for the Offering.

The directors of the Corporation have unanimously approved the terms of the Offering.

The securities to be issued pursuant to the Offering have not been, and will not be, registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”) or any U.S. state securities laws and may not be offered or sold in the United States absent registration or an available exemption from the registration requirement of the U.S. Securities Act and applicable U.S. state securities laws. This press release shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of, such securities in any jurisdiction in which such offer, solicitation or sale would be unlawful.

About TRU Precious Metals Corp.

TRU (TSXV:TRU; OTCQB:TRUIF) is on a mission to build long-term shareholder value, through prudent natural resource property development and transactions. TRU is exploring for gold and copper in the highly prospective Central Newfoundland Gold Belt on its 100%-owned Golden Rose Project, originally optioned from TSX-listed Altius Minerals. Golden Rose is a regional-scale 240.25 km2 land package, including a recently-discovered 20 km district-scale structure, and an additional 45 km of strike length along the deposit-bearing Cape Ray - Valentine Lake Shear Zone, directly between Marathon Gold’s Valentine Gold Project and Matador Mining’s Cape Ray Gold Project. In addition, TRU has an option to acquire up to an aggregate 65% ownership interest in two claim packages covering 33.25 km2 including a 12 km strike length along the Shear Zone within Golden Rose.

TRU is a portfolio company of Resurgent Capital Corp. (“Resurgent”), a merchant bank providing venture capital markets advisory services and proprietary financing. Resurgent works with promising public and pre-public micro-capitalization companies listing on Canadian stock exchanges. For more information on Resurgent and its portfolio companies, please visit Resurgent’s website at https://www.resurgentcapital.ca/ or follow Resurgent on LinkedIn at https://ca.linkedin.com/company/resurgent-capital-corp.

For further information about TRU, please contact:

Joel Freudman

Co-Founder & CEO

TRU Precious Metals Corp.

Phone: 1-855-760-2TRU (2878)

Email: ir@trupreciousmetals.com

To connect with TRU via social media, below are links:

Acknowledgement

TRU would like to thank the Government of Newfoundland and Labrador for its past financial support through the Junior Exploration Assistance Program.

Forward-Looking Information

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This press release contains certain forward-looking statements, including those relating to the Offering and the use of proceeds thereof, and the Company’s relationship with Ormonde. These statements are based on numerous assumptions and the Company’s plans that are believed by management to be reasonable in the circumstances, and are subject to a number of risks and uncertainties, including without limitation: transaction execution risk relating to the Offering and related regulatory approvals; risks related to the ability of the Company to use the proceeds as intended; risks that current discussions may not lead to any future investments by Ormonde, risks inherent in mineral exploration activities; mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company’s properties; financing risk and the risk that the Company will not be able to raise sufficient funds to carry out its business plans; volatility in financial markets, economic conditions, and precious metals prices; and those other risks described in the Company’s continuous disclosure documents. Actual results may differ materially from results contemplated by the forward-looking statements herein. Investors and others should carefully consider the foregoing factors and should not place undue reliance on such forward-looking statements. The Company does not undertake to update any forward-looking statements herein except as required by applicable securities laws.

TRU Reports on Trenching Progress at Mark’s Pond High-Grade Gold Target at Golden Rose Project Abundant Visible Gold Mineralization Identified in New Trenches

TRU Precious Metals Corp. provides an update on its trenching and channel sampling program at the Mark’s Pond high-grade gold target at its Golden Rose Project located in the highly prospective Central Newfoundland Gold Belt.

Toronto, Ontario – June 7, 2023 – TRU Precious Metals Corp. (TSXV:TRU; OTCQB:TRUIF) (“TRU” or the “Company”) is pleased to provide an update on its trenching and channel sampling program at the Mark’s Pond high-grade gold target at its Golden Rose Project (“Golden Rose” or the “Project”) located in the highly prospective Central Newfoundland Gold Belt. Earlier this year, TRU reported high-grade gold channel sampling results from an initial Mark’s Pond trench (refer to TRU press release dated January 12, 2023). Trenching and channel sampling at Mark’s Pond began in mid-May and is expected to continue this month.

Two 50-100 metre (m) long trenches have already been finished approximately 100 m to the southwest and 90 m to the northeast of the main Northcott Zone trench completed last fall. In addition, several 25-30 m long trench extensions or test pits have been added to further expand the known strike length of several gold-bearing graphitic shear zones with quartz-carbonate veins including the newly discovered Northcott Gold Zone (Figure 1). High grade gold mineralization appears to be most prominent at the contact between the Rogerson Lake Conglomerate and mafic volcanic units at this location.

Gold panning of soil and till collected within or on the sides of these new trenches has identified a significant amount of pristine, fine-grained gold grains, especially next to newly uncovered shear zones and rock unit contacts. Visible gold has also been observed in bedrock exposed within these new trenches. Channel samples are being collected at 0.5 to 1 m continuous intervals in each trench (Figure 2) and include QAQC protocols. Assay results for the channel samples are still pending.

Terrane Geoscience Inc. recently completed their structural mapping and analysis of the Mark’s Pond trenches. Their structural analysis will be used for drill hole planning and understanding the subsurface nature of these mineralized and highly deformed shear zones at the contact between the Rogerson Lake Conglomerate and mafic volcanics. A new high-resolution drone (UAV) survey was also completed to capture the new trenches and will also be used for detailed mapping and modeling of the channel samples, rock units, and alteration and mineralized zones at surface. The high-resolution ground Magnetic-VLF data over the Mark’s Pond target area has been received from GroundTruth Exploration and is currently being compiled into GIS and Leapfrog Geo for 3D geological modeling and interpretation.

Combined, the high-resolution Mag-VLF and drone survey data, structural mapping data, and channel sampling results will provide the Company with a high degree of confidence when developing drill hole targets to intercept these mineralized zones at depth.

Once the Mark’s Pond trenching and channel sampling program has been completed, the exploration team will commence detailed prospecting and mapping in the Jacob’s Pond-Twin Ponds area to identify new copper and gold occurrences for future trenching and drilling in this region of Golden Rose.

Paul Ténière, TRU’s Vice President – Exploration commented, “I have been impressed by how quickly and efficiently our exploration team and contractors have completed our trenching and channel sampling program at Mark’s Pond, and this is a direct result of our detailed planning and preparation ahead of the start of our 2023 field season. We are already seeing abundant mineralization in these new trenches and the potential extension of the Northcott Gold Zone along strike for up to 200 metres, which is very exciting news.”

Figure 1: 2023 Mark’s Pond trenching program

Figure 2: West Trench at Mark’s Pond - mineralized quartz vein - containing abundant pyrite and chalcopyrite.

The Mark’s Pond target area is among the Company’s claims under option from Quadro Resources Ltd. (the “Optionor”) pursuant to an option agreement between the parties. Under such agreement, the Optionor will retain either a 49% interest or a 35% interest, as the case may be, in such claims depending on the extent, if any, to which TRU exercises its option.

Finally, the Company is also reporting that on May 29, 2023, it was issued an additional 1,000,000 special warrants convertible into common shares of Eastern Precious Metals Corp. (“Eastern”), for no additional cost, in accordance with the terms of the Company’s option agreement with Eastern (refer to TRU press release dated August 16, 2022). The Company understands that Eastern continues to advance its stock exchange listing process.

Qualified Person Statement

The scientific and technical information disclosed in this news release has been prepared and approved by Paul Ténière, M.Sc., P.Geo., Vice President of Exploration for TRU, and a Qualified Person as defined in NI 43-101.

About TRU Precious Metals Corp.

TRU (TSXV:TRU; OTCQB:TRUIF) is on a mission to build long-term shareholder value, through prudent natural resource property development and transactions. TRU is exploring for gold and copper in the highly prospective Central Newfoundland Gold Belt on its 100%-owned Golden Rose Project, originally optioned from TSX-listed Altius Minerals. Golden Rose is a regional-scale 240.25 km2 land package, including a recently-discovered 20 km district-scale structure, and an additional 45 km of strike length along the deposit-bearing Cape Ray - Valentine Lake Shear Zone, directly between Marathon Gold’s Valentine Gold Project and Matador Mining’s Cape Ray Gold Project. In addition, TRU has an option with Quadro Resources Ltd. to acquire up to an aggregate 65% ownership interest in two claim packages covering 33.25 km2 including a 12 km strike length along the Shear Zone within Golden Rose.

TRU is a portfolio company of Resurgent Capital Corp. (“Resurgent”), a merchant bank providing venture capital markets advisory services and proprietary financing. Resurgent works with promising public and pre-public micro-capitalization companies listing on Canadian stock exchanges. For more information on Resurgent and its portfolio companies, please visit Resurgent’s website at https://www.resurgentcapital.ca/ or follow Resurgent on LinkedIn at https://ca.linkedin.com/company/resurgent-capital-corp.

For further information about TRU, please contact:

Joel Freudman

Co-Founder & CEO

TRU Precious Metals Corp.

Phone: 1-855-760-2TRU (2878)

Email: ir@trupreciousmetals.com

To connect with TRU via social media, below are links:

Acknowledgement

TRU would like to thank the Government of Newfoundland and Labrador for its past financial support through the Junior Exploration Assistance Program.

Forward-Looking Statements

This press release contains certain forward-looking statements, including those relating to exploration activities at Golden Rose, and to Eastern’s stock exchange listing process. These statements are based on numerous assumptions regarding Golden Rose and Eastern that are believed by management to be reasonable in the circumstances and are subject to a number of risks and uncertainties, including without limitation: mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on Golden Rose; the exploration potential of Golden Rose and the nature and style of mineralization; risks inherent in mineral exploration activities; volatility in financial markets, economic conditions, and precious metals and base metals prices; risks relating to Eastern’s listing process; and those other risks described in the Company’s continuous disclosure documents. Actual results may differ materially from results contemplated by the forward-looking statements herein. Investors and others should carefully consider the foregoing factors and should not place undue reliance on such forward-looking statements. The Company does not undertake to update any forward-looking statements herein except as required by applicable securities laws.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

TRU Commences Exploration Field Season at Golden Rose Project

TRU Precious Metals Corp. announces the start of its 2023 field exploration season at its 100% owned Golden Rose Project located in the highly prospective Central Newfoundland Gold Belt.

Toronto, Ontario – May 17, 2023 – TRU Precious Metals Corp. (TSXV:TRU; OTCQB:TRUIF) (“TRU” or the “Company”) is pleased to announce the start of its 2023 field exploration season at its 100% owned Golden Rose Project (“Golden Rose” or the “Project”) located in the highly prospective Central Newfoundland Gold Belt.

In March 2023, the Company commissioned GroundTruth Exploration (“GroundTruth”) of Dawson, YT to complete a high-resolution ground magnetometer-VLF (Very Low Frequency) geophysical survey (the “Mag-VLF survey”) over the Mark’s Pond area where the Company reported high-grade gold channel sample results as high as 57.6 g/t Au over 2.5m (refer to TRU news release dated January 12, 2023). The Mag-VLF survey was designed to potentially identify the extent of the shear zone hosting the high-grade Northcott Gold Zone to the northeast and southwest and to further investigate the potential for additional parallel shear zones and mineralized fault structures in the vicinity. The Mag-VLF survey is now complete with final interpreted results expected from GroundTruth within the next 2 to 3 weeks. Final geophysical results will be announced once received.

The TRU exploration team has recently commenced field work at the Mark’s Pond target area including the remaining channel sampling at the trench opened up in fall 2022. This will be followed by the completion of at least 3 to 4 new trenches at Mark’s Pond spaced at least 100 m apart with the aim to potentially trace the Northcott Gold Zone and other parallel shear zones along strike in a NE-SW direction. The Company has also commissioned Terrane Geoscience Inc. (“Terrane”) of Halifax, NS to complete a structural mapping and analysis program at the Mark’s Pond and Jacob’s Pond trenches by the end of May. Terrane will collect structural orientation data and characterize tectonic fabrics, veining, and any other structures that could potentially control mineralization. Combined, these programs aim to develop several priority diamond drill hole targets at Mark’s Pond and Jacob’s Pond (Figure 1).

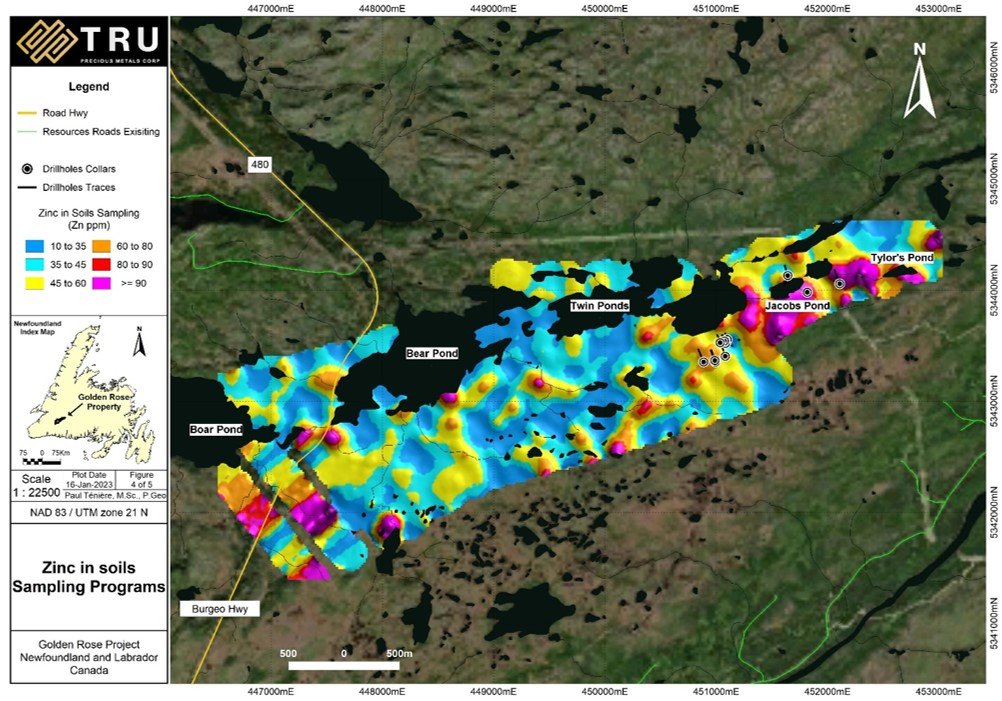

Paul Ténière, TRU’s Vice President – Exploration commented, “We are very excited to be back at Golden Rose to complete field programs that will further develop the Mark’s Pond target and lead to priority drill hole targets in the short term. The area southwest of Jacob’s Pond and south of Twin Ponds is also a top priority based on the 2022 soil geochemistry results indicating significant copper and gold-in-soil anomalies. We plan to commence exploration work at Jacob’s Pond once our trenching and channel sampling programs at Mark’s Pond have been completed, and we expect to complete detailed prospecting and mapping in this area leading to further trenching and channel sampling programs.”

Figure 1: Golden Rose Project Location Map

The Mark’s Pond target area is among the Company’s claims under option from Quadro Resources Ltd. (the “Optionor”) pursuant to an option agreement between the parties. Under such agreement, the Optionor will retain either a 49% interest or a 35% interest, as the case may be, in such claims depending on the extent, if any, to which TRU exercises its option.

Qualified Person Statement

The scientific and technical information disclosed in this news release has been prepared and approved by Paul Ténière, M.Sc., P.Geo., Vice President of Exploration for TRU, and a Qualified Person as defined in NI 43-101.

About TRU Precious Metals Corp.

TRU (TSXV:TRU; OTCQB:TRUIF) is on a mission to build long-term shareholder value, through prudent natural resource property development and transactions. TRU is exploring for gold and copper in the highly prospective Central Newfoundland Gold Belt on its 100%-owned Golden Rose Project, originally optioned from TSX-listed Altius Minerals. Golden Rose is a regional-scale 240.25 km2 land package, including a recently-discovered 20 km district-scale structure, and an additional 45 km of strike length along the deposit-bearing Cape Ray - Valentine Lake Shear Zone, directly between Marathon Gold’s Valentine Gold Project and Matador Mining’s Cape Ray Gold Project. In addition, TRU has an option with Quadro Resources Ltd. to acquire up to an aggregate 65% ownership interest in two claim packages covering 33.25 km2 including a 12 km strike length along the Shear Zone within Golden Rose.

TRU is a portfolio company of Resurgent Capital Corp. (“Resurgent”), a merchant bank providing venture capital markets advisory services and proprietary financing. Resurgent works with promising public and pre-public micro-capitalization companies listing on Canadian stock exchanges. For more information on Resurgent and its portfolio companies, please visit Resurgent’s website at https://www.resurgentcapital.ca/ or follow Resurgent on LinkedIn at https://ca.linkedin.com/company/resurgent-capital-corp.

For further information about TRU, please contact:

Joel Freudman

Co-Founder & CEO

TRU Precious Metals Corp.

Phone: 1-855-760-2TRU (2878)

Email: ir@trupreciousmetals.com

To connect with TRU via social media, below are links:

Acknowledgement

TRU would like to thank the Government of Newfoundland and Labrador for its past financial support through the Junior Exploration Assistance Program.

Forward-Looking Statements

This press release contains certain forward-looking statements, including those relating to exploration activities at Golden Rose. These statements are based on numerous assumptions regarding Golden Rose that are believed by management to be reasonable in the circumstances and are subject to a number of risks and uncertainties, including without limitation: mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on Golden Rose; the exploration potential of Golden Rose and the nature and style of mineralization; risks inherent in mineral exploration activities; volatility in financial markets, economic conditions, and precious metals and base metals prices; and those other risks described in the Company’s continuous disclosure documents. Actual results may differ materially from results contemplated by the forward-looking statements herein. Investors and others should carefully consider the foregoing factors and should not place undue reliance on such forward-looking statements. The Company does not undertake to update any forward-looking statements herein except as required by applicable securities laws.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

TRU Closes Oversubscribed Non-Brokered Private Placement

TRU Precious Metals Corp. announces the closing of a non-brokered private placement for gross proceeds of $528,500.

THIS NEWS RELEASE IS NOT INTENDED FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

Toronto, Ontario – May 3, 2023 – TRU Precious Metals Corp. (TSXV:TRU; OTCQB:TRUIF) (“TRU” or the “Company”) is pleased to announce the closing of a non-brokered private placement for gross proceeds of $528,500 (the “Offering”).

Joel Freudman, Co-Founder and CEO of TRU, commented, “The closing of this financing is a testament to the opportunity TRU presents, with strong support from the board and management and other core investors despite challenging market conditions. We’re especially pleased to have secured a large investment from Resurgent Capital Corp., a founding shareholder and long-standing supporter. Their significant investment at this stage of TRU’s growth strongly indicates their belief in TRU’s Golden Rose Project.”

The Company raised gross proceeds of $528,500 from the issuance of 10,570,000 units (“Units”) at a price of $0.05 per Unit. Each Unit is comprised of one (1) common share of the Company (a “Share”) and one (1) Share purchase warrant (a “Warrant”), with each Warrant entitling the holder thereof to purchase one (1) Share at a price of $0.075 for a period of 36 months following the closing date for the Offering.

The net proceeds of the Offering will primarily be used for approximately 1,000 metres of test drilling of high-grade gold zones at the Mark’s Pond target area at the Company’s Golden Rose Project in central Newfoundland (refer to January 12, 2023, press release). A portion of the proceeds from the Offering will also be used for corporate and public company purposes.

Mr. Freudman continued: “Not only are we already starting fieldwork in preparation for an exciting summer drill program, but we’ve also commenced several internal initiatives to optimize our costs and capital structure for a more streamlined organization going forward. Our commitment to building value for our shareholders continues to be a key component of our strategy.”

Subscriptions by insiders of the Company accounted for $150,000 of the gross proceeds of the Offering. Participation by insiders in the Offering is exempt from the valuation and minority shareholder approval requirements of Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions by virtue of the exemptions contained in Sections 5.5(b) and 5.7(1)(b).

The securities issued are subject to a statutory hold period expiring September 3, 2023. The Offering is subject to final approval of the TSX Venture Exchange.

Eligible finders received cash commissions equal to an aggregate of $17,600, and an aggregate of 352,000 finder warrants, each of which entitles the holder thereof to purchase one (1) Share at a price of $0.075 for a period of 36 months following the Closing Date.

The securities issued pursuant to the Offering have not been, and will not be, registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”) or any U.S. state securities laws and may not be offered or sold in the United States absent registration or an available exemption from the registration requirement of the U.S. Securities Act and applicable U.S. state securities laws. This press release shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of, such securities in any jurisdiction in which such offer, solicitation or sale would be unlawful.

As part of its capital structure optimization efforts, the Company also announces that an aggregate of 5,049,273 stock options and warrants have been voluntarily forfeited by officers, directors, employees and consultants.

About TRU Precious Metals Corp.