TRU NEWS

All disclosure filings, including news releases and financial documents can be found on the TRU Precious Metals SEDAR page.

TRU Precious Metals completes oversubscribed private placement of subscription receipts for gross proceeds of $3.5 Million with a lead order from Palisades Goldcorp

Fredericton, New Brunswick – March 5, 2021 – Further to its press releases dated February 16, 2021 and March 1, 2021, TRU Precious Metals Corp. (TSXV:TRU; OTCQB:TRUIF) (“TRU” or the “Company”) is pleased to announce that it has completed its oversubscribed non-brokered private placement (the “Offering”) for gross proceeds of $3,500,211.66, with a lead order from Palisades Goldcorp Ltd. (“Palisades”).

THIS NEWS RELEASE IS NOT INTENDED FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

Fredericton, New Brunswick – March 5, 2021 – Further to its press releases dated February 16, 2021 and March 1, 2021, TRU Precious Metals Corp. (TSXV:TRU; OTCQB:TRUIF) (“TRU” or the “Company”) is pleased to announce that it has completed its oversubscribed non-brokered private placement (the “Offering”) for gross proceeds of $3,500,211.66, with a lead order from Palisades Goldcorp Ltd. (“Palisades”). Pursuant to the Offering, TRU issued 15,910,053 subscription receipts (the "Subscription Receipts") at a price of $0.22 per Subscription Receipt. The Offering is subject to the final approval of the TSX Venture Exchange (the “Exchange”).

TRU Co-Founder and CEO Joel Freudman commented, “By successfully completing this Offering, we have secured the funds to finance our comprehensive exploration program in the Central Newfoundland Gold Belt on our Golden Rose Project as well as a defined phase 1 drilling program at our 100 percent owned Twilite Gold Project. Notwithstanding some headwinds from a consolidating gold market, this Offering was considerably oversubscribed with the lead order from Palisades Goldcorp Ltd. and orders from several institutions both in Canada and the US and from existing long-term shareholders. We are well-positioned to enhance our growth and are excited to continue to build value for our enlarged shareholder base.”

Each Subscription Receipt will, upon completion of the Company’s Change of Business (as defined below) and certain other customary conditions for a transaction of this nature, be automatically exercised into one unit of the Company (each, a “Unit”). Each Unit will be comprised of one (1) common share in the capital of the Company (each, a “Share”) and one (1) Share purchase warrant (each, a “Warrant”), with each Warrant entitling the holder thereof to purchase one Share at a price of $0.35 for a period of 36 months following the date of closing of the Offering (the "Closing Date").

Subscriptions by insiders of the Company accounted for $104,699.98 of the gross proceeds of the Offering. Participation by insiders in the Offering is exempt from the valuation and minority shareholder approval requirements of Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions by virtue of the exemptions contained in Sections 5.5(b) and 5.7(1)(b).

As previously announced by TRU on February 24, 2021, the Company has entered into an option agreement dated February 23, 2021 with a subsidiary of TSX-listed Altius Minerals Corporation (“Altius”) for the option to purchase the Golden Rose Project located in the Central Newfoundland Gold Belt, which transaction will constitute a Change of Business (the “Change of Business”) under the policies of the Exchange.

The net proceeds from the Offering will be used by the Company to fund its comprehensive exploration program on the Golden Rose Project; a limited phase one drilling program at the Company’s 100%-owned Twilite Gold Project, also in the Central Newfoundland Gold Belt; for general corporate and public company purposes, including hiring additional technical personnel and conducting various marketing initiatives; and to add to working capital for the operations of the Company.

The Subscription Receipts issued in the Offering, and the underlying Units, Shares, and Warrants, will be subject to a statutory hold period expiring July 5, 2021.

Upon completion of the Change of Business, eligible finders will receive, on account of gross proceeds raised from subscribers to the Offering who were introduced by such finders, (a) a cash commission equal to an aggregate of $112,696.61, and (b) an aggregate of 526,257 non-transferrable finder warrants, each of which will entitle the holder thereof to purchase one Share at a price of $0.22 for a period of 36 months following the Closing Date.

The securities issued pursuant to the Offering have not been, and will not be, registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”), or any U.S. state securities laws and may not be offered or sold in the United States absent registration or an available exemption from the registration requirement of the U.S. Securities Act and applicable U.S. state securities laws. This press release shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of, such securities in any jurisdiction in which such offer, solicitation or sale would be unlawful.

About TRU Precious Metals Corp.

TRU has assembled a portfolio of 5 gold exploration properties in the highly prospective Central Newfoundland Gold Belt. The Company has entered into a definitive option agreement with a subsidiary of TSX-listed Altius Minerals Corporation for the option to purchase 100% of the Golden Rose Project, located along the deposit-bearing Cape Ray – Valentine Lake Shear Zone. TRU also owns 100% of the Twilite Gold Project, located along the same Shear Zone, and 3 under-explored properties including its Rolling Pond Property (under option) bordering New Found Gold Corp.’s high-grade Queensway Project. TRU’s common shares trade on the TSX Venture Exchange under the symbol “TRU” and on the OTCQB Venture Market under the symbol “TRUIF”.

TRU is a portfolio company of Resurgent Capital Corp. (“Resurgent”), a merchant bank providing venture capital markets advisory services and proprietary financing. Resurgent works with promising public and pre-public micro-capitalization Canadian companies. For more information on Resurgent and its portfolio companies, please visit Resurgent’s LinkedIn profile at https://ca.linkedin.com/company/resurgent-capital-corp.

About Palisades Goldcorp Ltd.

Palisades Goldcorp is Canada’s resource focused merchant bank. Palisades’ management team has a demonstrated track record of making money and is backed by many of the industry’s most notable financiers. With junior resource equities valued at generational lows, management believes the sector is on the cusp of a major bull market move. Palisades is positioning itself with significant stakes in undervalued companies and assets with the goal of generating superior returns.

For further information, please contact:

Joel Freudman

Co-Founder, President & CEO

TRU Precious Metals Corp.

Phone: (647) 880-6414

Email: info@trupreciousmetals.com

Website: www.trupreciousmetals.com

To connect with TRU via social media, below are links:

Facebook

https://www.facebook.com/TRU-Precious-Metals-Corp-100919195193616

Twitter

https://twitter.com/corp_tru

LinkedIn

https://www.linkedin.com/company/tru-precious-metals-corp

YouTube

https://www.youtube.com/channel/UCHghHMDQaYgS1rDHiZIeLUg/

Cautionary Statements

Completion of the transactions contemplated herein is subject to a number of conditions, including but not limited to Exchange acceptance and, if applicable, disinterested shareholder approval. Where applicable, the transactions cannot close until the required shareholder approval is obtained. There can be no assurance that the transactions will be completed as proposed or at all.

Investors are cautioned that, except as disclosed in the filing statement to be prepared in connection with the transaction, any information released or received with respect to the Change of Business may not be accurate or complete and should not be relied upon. Trading in the securities of the Company should be considered highly speculative.

The Exchange has in no way passed upon the merits of the proposed transaction and has neither approved nor disapproved the contents of this press release. Neither the Exchange nor its Regulation Services Provider (as that term is defined in policies of the Exchange) accepts responsibility for the adequacy or accuracy of this release.

The links included in this press release are included as inactive textual reference for reference purposes only and the information on or connected to those websites are not part of, or incorporated by reference into, this press release.

This press release contains certain forward-looking statements, including those relating to the Offering and the anticipated use of proceeds thereof, the Change of Business, the Company’s transaction with Altius for the Golden Rose Project and the Company’s plans regarding acquiring, exploring, and monetizing the Golden Rose Project and the Company’s other mineral exploration properties. These statements are based on numerous assumptions regarding the Offering, the Golden Rose Project, the transaction with Altius and the Change of Business that are believed by management to be reasonable in the circumstances, and are subject to a number of risks and uncertainties, including without limitation: risks related to the ability of the Company to satisfy the conditions of the Change of Business, and to close the Change of Business; the ability of the Company to accomplish its plans and objectives with respect to its exploration projects, within the expected timing or at all; challenges in identifying, structuring, and executing transactions on favourable terms or at all; risks inherent in mineral exploration activities; volatility in financial markets, economic conditions, and precious metals prices; and those other risks described in the Company’s continuous disclosure documents. Actual results may differ materially from results contemplated by the forward-looking statements herein. Investors and others should carefully consider the foregoing factors and should not place undue reliance on such forward-looking statements. The Company does not undertake to update any forward-looking statements herein except as required by applicable securities laws.

TRU Precious Metals announces oversubscribed private placement of subscription receipts with a lead order from Palisades Goldcorp

Fredericton, New Brunswick – March 1, 2021 – Further to its press release dated February 16, 2021, TRU Precious Metals Corp. (TSXV:TRU; OTCQB:TRUIF) (“TRU” or the “Company”) is pleased to announce that it is upsizing its non-brokered private placement (the “Offering”) due to strong investor demand.

THIS NEWS RELEASE IS NOT INTENDED FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

Fredericton, New Brunswick – March 1, 2021 – Further to its press release dated February 16, 2021, TRU Precious Metals Corp. (TSXV:TRU; OTCQB:TRUIF) (“TRU” or the “Company”) is pleased to announce that it is upsizing its non-brokered private placement (the “Offering”) due to strong investor demand. The Company now anticipates that the Offering will be completed for gross proceeds of not less than $2,500,000, consisting of not less than 11,363,637 subscription receipts (the "Subscription Receipts") at a price of $0.22 per Subscription Receipt, subject to TSX Venture Exchange (the “Exchange”) approval, with a lead order from Palisades Goldcorp Ltd. (“Palisades”).

TRU Co-Founder and CEO Joel Freudman commented: “We are very pleased with the significant demand we are seeing for the Offering. TRU anticipates participation from several institutional investors, including the lead order from Palisades, and retail brokerages, as well as existing shareholders and members of management and the board of directors. As a result, TRU determined to upsize the Offering with a view to fully funding its near-term exploration plans for the Golden Rose Project, among other initiatives to build shareholder value.”

Each Subscription Receipt will, upon completion of the Company's Change of Business (as defined below) and certain other customary conditions for a transaction of this nature, be automatically exercised into one unit of the Company (each, a “Unit”). Each Unit will be comprised of one (1) common share in the capital of the Company (each, a “Share”) and one (1) Share purchase warrant (each, a “Warrant”), with each Warrant entitling the holder thereof to purchase one Share at a price of $0.35 for a period of 36 months following the date of closing of the Offering (the "Closing Date"), scheduled for March 4, 2021.

As previously announced by TRU on February 24, 2021, the Company has entered into an option agreement dated February 23, 2021 with a subsidiary of TSX-listed Altius Minerals Corporation (“Altius”) for the option to purchase the Golden Rose Project located in the Central Newfoundland Gold Belt, which transaction will constitute a Change of Business (the “Change of Business”) under the policies of the Exchange.

The net proceeds from the Offering will be used by the Company to fund its comprehensive exploration program on the Golden Rose Project; a limited phase one drilling program at the Company’s 100%-owned Twilite Gold Project, also in the Central Newfoundland Gold Belt; for general corporate and public company purposes, including hiring additional technical personnel and conducting various marketing initiatives; and to add to working capital for the operations of the Company. The Company has received conditional approval from the Exchange for the Offering for maximum gross proceeds of up to $3,500,000.

The Subscription Receipts issued in the Offering, and the underlying Units, Shares, and Warrants, will be subject to a hold period of four months and one day from the Closing Date.

Upon completion of the Change of Business, eligible finders will receive (a) a cash commission equal to 7% of the gross proceeds raised from subscribers to the Offering who were introduced by such finder, and (b) such number of non-transferrable finder warrants (“Finder Warrants”) as is equivalent to 7% of the number of Subscription Receipts issued to such subscribers. Each Finder Warrant will entitle the holder thereof to purchase one Share at a price of $0.22 for a period of 36 months following the Closing Date.

In addition, the Company announces that it has entered into a second amendment agreement (the “Second Amendment”) to the loan (the “Loan”) previously advanced by the Company to Revive Organics Inc. (“Revive Superfoods”), as set out in the Company’s press release dated March 20, 2020. The Loan is a legacy investment made by the Company that is being fully repaid in connection with the Company’s Change of Business. Pursuant to the Second Amendment, the payment schedule for the Loan has been updated as follows, inclusive of interest: $100,000 due on March 5, 2021; $336,250 due on March 31, 2021; $223,500 due on April 30, 2021; and $201,667 due on May 31, 2021. As consideration for entering into the Second Amendment, Revive Superfoods will also pay the Company a one-time fee of $21,000 on May 31, 2021.

About TRU Precious Metals Corp.

TRU has assembled a portfolio of 5 gold exploration properties in the highly prospective Central Newfoundland Gold Belt. The Company has entered into a definitive option agreement with a subsidiary of TSX-listed Altius Minerals Corporation for the option to purchase 100% of the Golden Rose Project, located along the deposit-bearing Cape Ray – Valentine Lake Shear Zone. TRU also owns 100% of the Twilite Gold Project, located along the same Shear Zone, and 3 under-explored properties including its Rolling Pond Property (under option) bordering New Found Gold Corp.’s high-grade Queensway Project. TRU’s common shares trade on the TSX Venture Exchange under the symbol “TRU” and on the OTCQB Venture Market under the symbol “TRUIF”.

TRU is a portfolio company of Resurgent Capital Corp. (“Resurgent”), a merchant bank providing venture capital markets advisory services and proprietary financing. Resurgent works with promising public and pre-public micro-capitalization Canadian companies. For more information on Resurgent and its portfolio companies, please visit Resurgent’s LinkedIn profile at https://ca.linkedin.com/company/resurgent-capital-corp.

For further information, please contact:

Joel Freudman

Co-Founder, President & CEO

TRU Precious Metals Corp.

Phone: (647) 880-6414

Email: info@trupreciousmetals.com

Website: www.trupreciousmetals.com

To connect with TRU via social media, below are links:

Facebook

https://www.facebook.com/TRU-Precious-Metals-Corp-100919195193616

Twitter

https://twitter.com/corp_tru

LinkedIn

https://www.linkedin.com/company/tru-precious-metals-corp

YouTube

https://www.youtube.com/channel/UCHghHMDQaYgS1rDHiZIeLUg/

Cautionary Statements

Completion of the transactions contemplated herein is subject to a number of conditions, including but not limited to Exchange acceptance and, if applicable, disinterested shareholder approval. Where applicable, the transactions cannot close until the required shareholder approval is obtained. There can be no assurance that the transactions will be completed as proposed or at all.

Investors are cautioned that, except as disclosed in the filing statement to be prepared in connection with the transaction, any information released or received with respect to the Change of Business may not be accurate or complete and should not be relied upon. Trading in the securities of the Company should be considered highly speculative.

The Exchange has in no way passed upon the merits of the proposed transaction and has neither approved nor disapproved the contents of this press release. Neither the Exchange nor its Regulation Services Provider (as that term is defined in policies of the Exchange) accepts responsibility for the adequacy or accuracy of this release.

The links included in this press release are included as inactive textual reference for reference purposes only and the information on or connected to those websites are not part of, or incorporated by reference into, this press release.

This press release contains certain forward-looking statements, including those relating to the Offering and the anticipated closing date and use of proceeds thereof, the Change of Business, the Company's transaction with Altius for the Golden Rose Project, the Company's plans regarding acquiring, exploring, and monetizing the Golden Rose Project and the Company’s other mineral exploration properties, and the timing of repayment of the Loan. These statements are based on numerous assumptions regarding the Offering, the Golden Rose Project, the transaction with Altius, the Change of Business and the Loan that are believed by management to be reasonable in the circumstances, and are subject to a number of risks and uncertainties, including without limitation: risks related to the ability of the Company to satisfy the conditions of the Offering and the Change of Business, and to close the Offering and subsequently the Change of Business; the ability of the Company to accomplish its plans and objectives with respect to its exploration projects, within the expected timing or at all; challenges in identifying, structuring, and executing transactions on favourable terms or at all; risks inherent in mineral exploration activities; Loan repayment risk; volatility in financial markets, economic conditions, and precious metals prices; and those other risks described in the Company’s continuous disclosure documents. Actual results may differ materially from results contemplated by the forward-looking statements herein. Investors and others should carefully consider the foregoing factors and should not place undue reliance on such forward-looking statements. The Company does not undertake to update any forward-looking statements herein except as required by applicable securities laws.

TRU Precious Metals engages Momentum and MI3 for Québec Investor Relations

Fredericton, New Brunswick – February 25, 2021 – TRU Precious Metals Corp. (TSXV: TRU) (OTCQB: TRUIF) (“TRU” or the “Company”) is pleased to announce that, subject to regulatory approval by the TSX Venture Exchange (the “TSXV”), it has engaged Momentum Public Relations Inc. (“Momentum”) and MI3 Communications Financières Inc. (“MI3”) to spearhead the Company’s investor relations efforts predominantly in the province of Québec.

Fredericton, New Brunswick – February 25, 2021 – TRU Precious Metals Corp. (TSXV: TRU) (OTCQB: TRUIF) (“TRU” or the “Company”) is pleased to announce that, subject to regulatory approval by the TSX Venture Exchange (the “TSXV”), it has engaged Momentum Public Relations Inc. (“Momentum”) and MI3 Communications Financières Inc. (“MI3”) to spearhead the Company’s investor relations efforts predominantly in the province of Québec.

Momentum will assist the Company by facilitating dialogues with investors and stockbrokers, and by advising the Company on various financing alternatives. As consideration for these services, the Company has agreed to pay Momentum a monthly cash fee of CAD$9,200, for a 6-month term scheduled to commence on April 1, 2021. The Company has also agreed that, following completion of its TSXV Change of Business (as such term is defined in TSXV policies) and resumption of trading of the Company’s shares on the TSXV, it will grant Momentum 450,000 incentive stock options (“Options”) on terms to be determined by TRU’s board of directors (the “Board”) and in accordance with the Company’s stock option plan (the “SOP”) and TSXV policies.

MI3 will provide the Company with a wide range of publicity and investor relations services, including conducting targeted communications campaigns following notable developments about the Company, and arranging virtual introductions to and roadshows with stockbrokers and high-net-worth individuals. As consideration for these services, the Company has agreed to pay MI3 a monthly cash fee of CAD$5,000, for an initial 6-month term scheduled to commence on April 1, 2021. The Company has also agreed that, following completion of its TSXV Change of Business and resumption of trading of the Company’s shares on the TSXV, it will grant MI3 100,000 Options on terms to be determined by the Board and in accordance with the SOP and TSXV policies.

Each of Momentum and MI3 act at arm’s length to TRU and do not currently have any interest, directly or indirectly, in the Company or its securities. Each of Momentum and MI3 intends to acquire securities of TRU in the future.

About Momentum Public Relations Inc.

Momentum is a Montréal-based public relations and investor relations firm that assists public companies in distributing their messaging to target audiences within the North American investment community. Through a national network of institutional investors, analysts and financial media relationships, the team communicates each client’s value drivers, growth potential and developmental vision clearly and efficiently. The experienced team of communications specialists works closely with senior management of each client to build publicity campaigns while executing on a long-term investor relations strategy that remains flexible to respond to immediate changes. Momentum’s address is Suite 109 - 50 La Barre Street, Longueuil, Québec, J4K 5G2. For further information about Momentum, please visit https://momentumpr.com/.

About MI3 Communications Financières Inc.

Launched in 2007, MI3 is a Montréal-based financial communications and investor relations firm geared for today’s fast-paced global economy. MI3’s services were developed to leverage the trading and market experience of its bilingual team to provide public relations, market-making activities and investor relations to Canadian public companies. MI3’s address is Suite 402 - 590 Jacques Lavigne, Ste-Thérèse, Québec, J7E 0A8. For further information about MI3, please visit http://mi3.ca/.

About TRU Precious Metals Corp.

TRU has assembled a portfolio of 5 gold exploration properties in the highly prospective Central Newfoundland Gold Belt. The Company has entered into a definitive option agreement with a subsidiary of TSX-listed Altius Minerals Corporation for the option to purchase 100% of the Golden Rose Project, located along the deposit-bearing Cape Ray – Valentine Lake Shear Zone. TRU also owns 100% of the Twilite Gold Project, located along the same Shear Zone, and 3 under-explored properties including its Rolling Pond Property (under option) bordering New Found Gold Corp.’s high-grade Queensway Project. TRU’s common shares trade on the TSX Venture Exchange under the symbol “TRU” and on the OTCQB Venture Market under the symbol “TRUIF”.

TRU is a portfolio company of Resurgent Capital Corp. (“Resurgent”), a merchant bank providing venture capital markets advisory services and proprietary financing. Resurgent works with promising public and pre-public micro-capitalization Canadian companies. For more information on Resurgent and its portfolio companies, please visit Resurgent’s LinkedIn profile at https://ca.linkedin.com/company/resurgent-capital-corp.

For further information, please contact:

Joel Freudman

Co-Founder, President & CEO

TRU Precious Metals Corp.

Phone: (647) 880-6414

Email: info@trupreciousmetals.com

Website: www.trupreciousmetals.com

To connect with TRU via social media, below are links:

Facebook

https://www.facebook.com/TRU-Precious-Metals-Corp-100919195193616

Twitter

https://twitter.com/corp_tru

LinkedIn

https://www.linkedin.com/company/tru-precious-metals-corp

YouTube

https://www.youtube.com/channel/UCHghHMDQaYgS1rDHiZIeLUg/

Cautionary Statements

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This press release contains certain forward-looking statements, including those relating to regulatory approval and the Company’s ongoing relationships with Momentum and MI3. These statements are based on numerous assumptions regarding the Company’s corporate and investor relations strategies that are believed by management to be reasonable in the circumstances, and are subject to a number of risks and uncertainties, including without limitation: regulatory approval processes; challenges in attracting and retaining qualified personnel; volatility in financial markets, economic conditions, and precious metals prices; and those other risks described in the Company’s continuous disclosure documents. Actual results may differ materially from results contemplated by the forward-looking statements herein. Investors and others should carefully consider the foregoing factors and should not place undue reliance on such forward-looking statements. The Company does not undertake to update any forward-looking statements herein except as required by applicable securities laws.

TRU Precious Metals Signs Definitive Option Agreement with Subsidiary of Altius Minerals to Purchase Golden Rose Project

Fredericton, New Brunswick – February 24, 2021 – TRU Precious Metals Corp. (TSXV:TRU; OTCQB:TRUIF) (“TRU” or the “Company”) is pleased to announce that it has signed a definitive option agreement dated February 23, 2021 (the “Option Agreement”) with a subsidiary of TSX-listed Altius Minerals Corporation (TSX:ALS) (“Altius”) to purchase Altius’ Golden Rose Project (as defined below).

Fredericton, New Brunswick – February 24, 2021 – TRU Precious Metals Corp. (TSXV:TRU; OTCQB:TRUIF) (“TRU” or the “Company”) is pleased to announce that it has signed a definitive option agreement dated February 23, 2021 (the “Option Agreement”) with a subsidiary of TSX-listed Altius Minerals Corporation (TSX:ALS) (“Altius”) to purchase Altius’ Golden Rose Project (as defined below). This is further to the Company’s press releases dated January 7, 2021 and February 2, 2021.

TRU Co-Founder and CEO Joel Freudman commented: “We are excited by the prospects of this historically explored property. Golden Rose is ideally located along the deposit-bearing Cape Ray – Valentine Lake Shear Zone, with highway access, in a mining-friendly jurisdiction. We believe that the long-term prospects for gold are very robust and as such we could not ignore the opportunity that we feel the Golden Rose Project represents. In addition, upon closing of this transaction, we will be delighted to welcome Altius to TRU’s shareholder base as a strategic investor, holding an approximate 19.9% stake.”

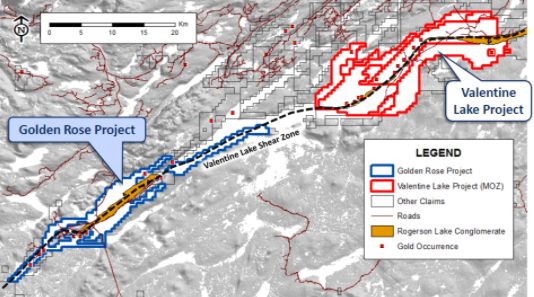

Golden Rose Project

The Golden Rose Project is a regional-scale land package covering 105 km2 within the Valentine Lake structural corridor, and is easily accessible via provincial highway and forest access roads. It is located between Marathon Gold Corp.’s Valentine Gold Project to the northeast and Matador Mining Ltd.’s Cape Ray Gold Project to the southwest.

Figure 1: Golden Rose Project Regional Location

A technical description of the Golden Rose Project is available in the Company’s press release dated January 7, 2021.

Terms of the Option Agreement

TRU has entered into the Option Agreement, by which Altius grants to TRU the exclusive right and option (the “Option”) to acquire, subject to retention by Altius of a maximum 2.0% net smelter return (“NSR”) royalty, its 100% interest in a package of mineral claims located in the southwestern portion of the Central Newfoundland Gold Belt (the “Altius Claims”). Altius has also agreed to assign an existing option agreement (the “Rose Gold Agreement”, and together with the Option Agreement, collectively, the “Transaction”) under which Shawn Rose (the “Rose Optionor”) has granted the exclusive right and option to acquire, subject to retention by the Rose Optionor of a royalty, his 100% interest in certain surrounding mineral claims known as the Rose Gold claims (the “Rose Gold Claims”). Collectively, the Altius Claims and the Rose Gold Claims, as well as any future claims added within a defined area of interest around the Rose Gold Claims and the Altius Claims, will be called the “Golden Rose Project”.

In order to acquire a 100% interest in the Golden Rose Project, the Company must issue such number of common shares in the capital of TRU (“TRU Shares”) as set forth below, and fund a total of $3,000,000 in exploration expenditures:

| Date | TRU Share Issuance | Exploration Funding Commitment |

|---|---|---|

| Closing Date ("Closing Date") of the Option Agreement |

7,140,000 TRU Shares, at a deemed price of $0.25 per TRU share |

Nil |

| By one (1) month from the Closing Date |

800,000 TRU shares, at a deemed price of $0.25 per TRU share |

Nil |

| By February 23, 2022 | 800,000 TRU Shares, at a deemed price of $0.25 per TRU Share |

$500,000 |

| By February 23, 2023 | 1,400,000 TRU Shares, at a deemed [price of $0.25 per TRU share |

An additional $1,000,000 |

| By February 23, 2024 | Nil | An additional $1,500,000 |

Notwithstanding the foregoing, the Option Agreement provides that on any given TRU Share issuance date only that number of TRU Shares will be issued which will result in the total shareholdings of Altius not exceeding 19.9% percent of the issued and outstanding TRU Shares as of the date of the issuance (provided such TRU Shares shall remain issuable by TRU prior to full exercise of the Option).

In addition, TRU must pay the Rose Optionor: (i) $22,500, in cash or by issuance of TRU Shares, at the election of the Rose Optionor, on November 30, 2021; and (ii) $37,500, in cash or by issuance of TRU Shares, at the election of the Rose Optionor, on November 30, 2022. The deemed value of such TRU Shares, if issued in lieu of cash, shall be the greater of (a) $0.25 per TRU Share and (b) the closing price of such TRU Shares on the TSX Venture Exchange (the “Exchange”), on the day prior to such payment date.

TRU will also have to pay the Rose Optionor a $250,000 cash bonus if TRU defines at least 1,000,000 ounces of gold on the Rose Gold Claims in the Measured & Indicated categories of a National Instrument 43-101 mineral resource estimate. TRU shall also grant the Rose Optionor a 2.0% NSR on any future mineral production at the Rose Gold Claims.

Upon TRU fulfilling the initial issuance of TRU Shares under the Option Agreement, Altius is expected to have an approximately 19.9% ownership interest in TRU, based on the current number of issued and outstanding TRU Shares. Altius also has a right to participate in future financings by TRU in order to maintain its ownership interest up to a maximum of 19.9%. Neither Altius nor the Rose Optionor is a Non-Arm’s Length Party (as such term is defined in Exchange Policy 1.1) to the Company, nor is the Rose Optionor a Non-Arm’s Length Party to Altius, and as such the Transaction is an Arm’s Length Transaction (as such term is defined in Exchange Policy 1.1).

Upon exercise of the Option, Altius will retain the NSR from any future mineral production at the Golden Rose Project, subject to a reduction for any underlying royalty obligations held by third parties, including the royalty retained by the Rose Optionor.

Pursuant to the Option Agreement, the completion of the Transaction is subject to a number of conditions including, among others: (i) conditional approval of the Exchange in respect of the Transaction and the listing of the TRU Shares to be issued pursuant thereto; (ii) requisite approval by the shareholders of the Company; (iii) Altius being the registered and beneficial owner of a 100% interest in the Golden Rose Project free and clear of all encumbrances, subject to as provided in the Rose Gold Agreement; (iv) TRU adding not less than $3,000,000 of gross cash proceeds from equity financing activities and property-level transactions by February 23, 2023; and (v) no material adverse change having occurred with respect to the Company or the Golden Rose Project. The TRU Shares are expected to remain halted from trading until on or shortly after the Closing Date.

Qualified Person

Barry Greene, P.Geo. is a qualified person as defined by National Instrument 43-101 and has reviewed and approved the contents and technical disclosures in this press release. Mr. Greene is a director and officer of the Company and owns securities of the Company.

About TRU Precious Metals Corp.

TRU has assembled a portfolio of 5 gold exploration properties in the highly prospective Central Newfoundland Gold Belt. The Company has entered into a definitive option agreement with a subsidiary of TSX-listed Altius Minerals Corporation (TSX:ALS) for the option to purchase 100% of the Golden Rose Project, located along the deposit-bearing Cape Ray – Valentine Lake Shear Zone. TRU also owns 100% of the Twilite Gold Project, located along the same Shear Zone, and 3 under-explored properties including its Rolling Pond Property (under option) bordering New Found Gold Corp.’s high-grade Queensway Project. TRU’s common shares trade on the TSX Venture Exchange under the symbol “TRU” and on the OTCQB Venture Market under the symbol “TRUIF”.

TRU is a portfolio company of Resurgent Capital Corp. (“Resurgent”), a merchant bank providing venture capital markets advisory services and proprietary financing. Resurgent works with promising public and pre-public micro-capitalization Canadian companies. For more information on Resurgent and its portfolio companies, please visit Resurgent’s LinkedIn profile at https://ca.linkedin.com/company/resurgent-capital-corp.

For further information, please contact:

Joel Freudman

Co-Founder, President & CEO

TRU Precious Metals Corp.

Phone: (647) 880-6414

Email: info@trupreciousmetals.com

Website: www.trupreciousmetals.com

To connect with TRU via social media, below are links:

Facebook

https://www.facebook.com/TRU-Precious-Metals-Corp-100919195193616

Twitter

https://twitter.com/corp_tru

LinkedIn

https://www.linkedin.com/company/tru-precious-metals-corp

YouTube

https://www.youtube.com/channel/UCHghHMDQaYgS1rDHiZIeLUg/

Cautionary Statements

Completion of the transactions contemplated herein is subject to a number of conditions, including but not limited to Exchange acceptance and, if applicable, disinterested shareholder approval. Where applicable, the transactions cannot close until the required shareholder approval is obtained. There can be no assurance that the transactions will be completed as proposed or at all.

Investors are cautioned that, except as disclosed in the filing statement to be prepared in connection with the transaction, any information released or received with respect to the Change of Business (as described in the Company’s press release dated February 2, 2021) may not be accurate or complete and should not be relied upon. Trading in the securities of the Company should be considered highly speculative.

The Exchange has in no way passed upon the merits of the proposed transaction and has neither approved nor disapproved the contents of this press release. Neither the Exchange nor its Regulation Services Provider (as that term is defined in policies of the Exchange) accepts responsibility for the adequacy or accuracy of this release.

This press release contains certain forward-looking statements, including those relating to completion of the Transaction, and the outlook for the gold sector. These statements are based on numerous assumptions regarding the Golden Rose Project, the Option, and the Transaction that are believed by management to be reasonable in the circumstances, and are subject to a number of risks and uncertainties, including without limitation:mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Golden Rose Project; the exploration or monetization potential of the Golden Rose Project and the nature and style of mineralization at the Golden Rose Project; challenges in identifying, structuring, and executing transactions on favourable terms or at all; risks inherent in mineral exploration activities; volatility in financial markets, economic conditions, and precious metals prices; and those other risks described in the Company’s continuous disclosure documents. Actual results may differ materially from results contemplated by the forward-looking statements herein. Investors and others should carefully consider the foregoing factors and should not place undue reliance on such forward-looking statements. The Company does not undertake to update any forward-looking statements herein except as required by applicable securities laws

TRU Precious Metals Announces Private Placement of Subscription Receipts with a Lead Order from Palisades Goldcorp

Fredericton, New Brunswick--(Newsfile Corp. - February 16, 2021) - TRU Precious Metals Corp. (TSXV:TRU) (OTCQB:TRUIF) ("TRU" or the "Company") is pleased to announce that it intends to undertake a non-brokered private placement for minimum gross proceeds of C$1,000,000 (the "Offering"), subject to TSX Venture Exchange (the "Exchange") approval, with a lead order from Palisades Goldcorp Ltd.

Fredericton, New Brunswick--(Newsfile Corp. - February 16, 2021) - TRU Precious Metals Corp. (TSXV:TRU) (OTCQB:TRUIF) ("TRU" or the "Company") is pleased to announce that it intends to undertake a non-brokered private placement for minimum gross proceeds of C$1,000,000 (the "Offering"), subject to TSX Venture Exchange (the "Exchange") approval, with a lead order from Palisades Goldcorp Ltd. The Offering shall consist of not less than 4,545,455 subscription receipts (the "Subscription Receipts") at a price of $0.22 per Subscription Receipt.

Each Subscription Receipt will, upon completion of the Company's Change of Business (as defined below) and certain other customary conditions for a transaction of this nature, be automatically exercised into one unit of the Company (each, a "Unit"). Each Unit will be comprised of one (1) common share in the capital of the Company (each, a "Share") and one (1) Share purchase warrant (each, a "Warrant"), with each Warrant entitling the holder thereof to purchase one Share at a price of $0.35 for a period of 36 months following the date of closing of the Offering (the "Closing Date"), currently anticipated to occur on March 4, 2021.

As previously announced by TRU on February 2, 2021, the Company has entered into a binding term sheet with a subsidiary of TSX-listed Altius Minerals Corporation ("Altius") for the option to purchase the Golden Rose Project located in the Central Newfoundland Gold Belt, which transaction will constitute a Change of Business (the "Change of Business") under the policies of the Exchange.

The net proceeds from the Offering will be used by the Company to fund its comprehensive exploration program on the Golden Rose Project; a limited phase one drilling program at the Company's 100%-owned Twilite Gold Project, also in the Central Newfoundland Gold Belt; for general corporate and public company purposes, including hiring additional technical personnel and conducting various marketing initiatives; and to add to working capital for the operations of the Company. The maximum gross proceeds under the Offering is C$2,000,000.

The Subscription Receipts issued in the Offering, and the underlying Units, Shares, and Warrants, will be subject to a hold period of four months and one day from the Closing Date.

Upon completion of the Change of Business, eligible finders will receive (a) a cash commission equal to 7% of the gross proceeds raised from subscribers to the Offering who were introduced by such finder, and (b) such number of non-transferrable finder warrants ("Finder Warrants") as is equivalent to 7% of the number of Subscription Receipts issued to such subscribers. Each Finder Warrant will entitle the holder thereof to purchase one Share at a price of $0.22 for a period of 36 months following the Closing Date.

About TRU Precious Metals Corp.

TRU has assembled a portfolio of 5 gold exploration properties in the highly prospective Central Newfoundland Gold Belt. The Company has entered into a binding term sheet with a subsidiary of TSX-listed Altius Minerals Corporation for the option to purchase 100% of the Golden Rose Project, located along the deposit-bearing Cape Ray - Valentine Lake Shear Zone. TRU also owns 100% of the Twilite Gold Project, located along the same Shear Zone, and 3 under-explored properties including its Rolling Pond Property (under option) bordering New Found Gold Corp.'s high-grade Queensway Project. TRU's common shares trade on the TSX Venture Exchange under the symbol "TRU" and on the OTCQB Venture Market under the symbol "TRUIF".

TRU is a portfolio company of Resurgent Capital Corp. ("Resurgent"), a merchant bank providing venture capital markets advisory services and proprietary financing. Resurgent works with promising public and pre-public micro-capitalization Canadian companies. For more information on Resurgent and its portfolio companies, please visit Resurgent's LinkedIn profile at https://ca.linkedin.com/company/resurgent-capital-corp.

About Palisades Goldcorp Ltd.

Palisades Goldcorp is Canada's resource focused merchant bank. Palisades' management team has a demonstrated track record of making money and is backed by many of the industry's most notable financiers. With junior resource equities valued at generational lows, management believes the sector is on the cusp of a major bull market move. Palisades is positioning itself with significant stakes in undervalued companies and assets with the goal of generating superior returns.

For further information, please contact:

Joel Freudman

Co-Founder, President & CEO

TRU Precious Metals Corp.

Phone: (647) 880-6414

Website: www.trupreciousmetals.com

To connect with TRU Precious Metals Corp. via social media, below are links:

To connect with TRU via social media, below are links:

Facebook

Twitter

LinkedIn

YouTube

Cautionary Statements

Completion of the transactions contemplated herein is subject to a number of conditions, including but not limited to Exchange acceptance and, if applicable, disinterested shareholder approval. Where applicable, the transactions cannot close until the required shareholder approval is obtained. There can be no assurance that the transactions will be completed as proposed or at all.

Investors are cautioned that, except as disclosed in the filing statement to be prepared in connection with the transaction, any information released or received with respect to the Change of Business may not be accurate or complete and should not be relied upon. Trading in the securities of the Company should be considered highly speculative.

The Exchange has in no way passed upon the merits of the proposed transaction and has neither approved nor disapproved the contents of this press release. Neither the Exchange nor its Regulation Services Provider (as that term is defined in policies of the Exchange) accepts responsibility for the adequacy or accuracy of this release.

The links included in this press release are included as inactive textual reference for reference purposes only and the information on or connected to those websites are not part of, or incorporated by reference into, this press release.

This press release contains certain forward-looking statements, including those relating to the Offering and the anticipated closing date and use of proceeds thereof, the Change of Business, the Company's transaction with Altius for the Golden Rose Project, and the Company's plans regarding acquiring, exploring, and monetizing the Golden Rose Project and the Company's other mineral exploration properties. These statements are based on numerous assumptions regarding the Offering, the Golden Rose Project, the transaction with Altius, and the Change of Business that are believed by management to be reasonable in the circumstances, and are subject to a number of risks and uncertainties, including without limitation: risks related to the ability of the Company to satisfy the conditions of the Offering and the Change of Business, and to close the Offering and subsequently the Change of Business; the ability of the Company to accomplish its plans and objectives with respect to its exploration projects, within the expected timing or at all; challenges in identifying, structuring, and executing transactions on favourable terms or at all; risks inherent in mineral exploration activities; volatility in financial markets, economic conditions, and precious metals prices; and those other risks described in the Company's continuous disclosure documents. Actual results may differ materially from results contemplated by the forward-looking statements herein. Investors and others should carefully consider the foregoing factors and should not place undue reliance on such forward-looking statements. The Company does not undertake to update any forward-looking statements herein except as required by applicable securities laws.

THIS NEWS RELEASE IS NOT INTENDED FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

TRU Precious Metals Provides Update on Transaction with Altius Minerals Subsidiary

Fredericton, New Brunswick--(Newsfile Corp. - February 2, 2021) - TRU Precious Metals Corp. (TSXV: TRU) (OTC: TRUIF) ("TRU" or the "Company") wishes to provide an update to the previously announced binding term sheet dated January 6, 2021, entered into with a subsidiary of TSX-listed Altius Minerals Corporation ("Altius"), for the option (the "Option") to purchase Altius' Golden Rose project (the "Golden Rose Project") located in the southwestern portion of the Central Newfoundland Gold Belt (the "Transaction").

Fredericton, New Brunswick – February 2, 2021 – TRU Precious Metals Corp. (TSXV:TRU; OTCQB:TRUIF) (“TRU” or the “Company”) wishes to provide an update to the previously announced binding term sheet dated January 6, 2021, entered into with a subsidiary of TSX-listed Altius Minerals Corporation ("Altius"), for the option (the "Option") to purchase Altius' Golden Rose project (the "Golden Rose Project") located in the southwestern portion of the Central Newfoundland Gold Belt (the "Transaction").

Change of Business

In connection with the Option, TRU has applied to the TSX Venture Exchange (the "Exchange") for a Change of Business (as such term is defined in Exchange Policy 5.2) to a "mining issuer" from its current classification as an "investment issuer" under the Exchange's policies. The Company expects all of its current officers and directors to remain in their existing roles with the Company during the Change of Business and thereafter.

Completion of the Change of Business is subject to a number of conditions including receipt of the approval of the Exchange. The Change of Business cannot close until approval of the Exchange is obtained. There can be no assurance that the Change of Business will be completed as proposed or at all.

Trading in the common shares in the capital of the Company ("TRU Shares") will remain halted pending further filings with the Exchange, including the Geological Report (as defined below), and are expected to remain halted for approximately 30 to 60 days during the Exchange review process. Following the trading halt, the Company will also take the necessary steps to resume trading of the TRU Shares on the OTCQB Venture Market.

In connection with the Change of Business, Altius and TRU have commissioned an independent geological report on the Golden Rose Project (the "Geological Report"), which is currently being prepared. Prior to completion of the Change of Business, a copy of the Geological Report will be filed and posted on SEDAR. Further information on the Option Agreement (as hereafter defined) and the Golden Rose Project will be filed and posted on SEDAR upon the completion of a filing statement that will be prepared in connection with the Change of Business. The parties are also currently negotiating the definitive Option Agreement.

TRU continues to evaluate various equity financing options in connection with the Option and the Change of Business, to bolster its treasury for its anticipated initial exploration commitment at the Golden Rose Project, along with the first phase of the Company's intended drill program at its 100%-owned Twilite Gold Project.

Golden Rose Project

The Golden Rose Project is a regional-scale land package covering 105 km2 within the Valentine Lake structural corridor, and is easily accessible via provincial highway and forest access roads. It is located between Marathon Gold Corp.'s Valentine Gold Project to the northeast and Matador Mining Ltd.'s Cape Ray Gold Project to the southwest.

Figure 1: Golden Rose Project Regional Location

A technical description of the Golden Rose Project is available in the Company's press release dated January 7, 2021. In 2020 Altius incurred approximately $41,275 of Approved Expenditures (as such term is defined in Exchange Policy 1.1) on the Golden Rose Project. In addition, Quadro Resources Ltd. ("Quadro"), the previous owner of the Staghorn Project, which included the Golden Rose Project, incurred approximately $480,000 in Approved Expenditures since Q4 of 2017.*

Terms of the Option

In order to acquire a 100% interest in the Golden Rose Project, the Company must issue such number of TRU Shares as set forth below, and fund a total of $3,000,000 in exploration expenditures:

| Share Issuance | Exploration Funding Commitment |

|---|---|

|

7,140,000 TRU Shares, at a deemed price of $0.25 per Share, upon the closing date of the definitive agreement to be entered into in respect of the Option (the "Option Agreement") |

Nil |

| 800,000 TRU Shares, at a deemed price of $0.25 per Share, on or before the date that is six (6) months from the date of the Option Agreement |

$500,000 within twelve (12) months from the date of the Option Agreement |

| 800,000 TRU Shares, at a deemed price of $0.25 per Share, on or before the date that is eighteen (18) months from the date of the Option Agreement |

$1,000,000 within twenty-four (24) months from the date of the Option Agreement |

| 1,400,000 TRU Shares, at a deemed price of $0.25 per Share, on or before the date that is twenty-four (24) months from the date of the Option Agreement |

$1,500,000 within thirty-six (36) months from the date of the Option Agreement |

Upon TRU fulfilling the initial issuance of TRU Shares under the Option Agreement, Altius is expected to have a 19.9% ownership interest in TRU based on the current number of issued and outstanding TRU Shares. The Transaction is an Arm's Length Transaction (as such term is defined in Exchange Policy 1.1).

Upon exercise of the Option, Altius will retain a 2.0% net smelter returns royalty from any future mineral production at the Golden Rose Project, subject to a reduction for any underlying royalty obligations held by third parties.

Pursuant to the Option Agreement, the completion of the Transaction is subject to a number of conditions including, among others: (i) conditional approval of the Exchange in respect of the Transaction and the listing of the TRU Shares to be issued to Altius; (ii) approval of the Change of Business by the shareholders of the Company; (iii) Altius being the registered and beneficial owner of a 100% interest in the Golden Rose Project free and clear of all encumbrances, subject to certain underlying royalties; (iv) the representations, warranties of the Company and Altius being true and correct as of closing; and (v) no material adverse change having occurred with respect to the Company and the Golden Rose Project.

The Transaction will not result in any new directors or officers joining the Company. Altius, as a greater than 10% shareholder of the Company, will become an Insider (as such term is defined in Exchange Policy 1.1) of the Company. The current directors and officers of the Company are as follows:

Joel Freudman - Co-Founder, CEO, President & Director

Joel Freudman is the Co-Founder, CEO and a Director of the Company. Mr. Freudman currently serves as the CEO & Director of both public and private mineral exploration companies. Mr. Freudman is the President of Resurgent Capital Corp. (2016 to present), a Toronto merchant bank focused on undervalued micro-capitalization Canadian public companies. Mr. Freudman is a member of the Law Society of Upper Canada, and holds a Juris Doctor degree from Western University and a Bachelor of Commerce degree from the University of Toronto.

Robert Harrison, FCGA, FCPA - CFO & Corporate Secretary

Robert Harrison is employed as the CFO and Corporate Secretary of the Company. Mr. Harrison has over 30 years of extensive accounting & bookkeeping experience across a host of sectors. Mr. Harrison is responsible for, among other things, preparing financial statements and maintaining corporate records. Mr. Harrison received his CGA designation in 1991 and was awarded the FCGA fellowship designation in 2002. Mr. Harrison is also CFO to other public and private mineral exploration companies.

Damian Lopez - Chair of The Board of Directors

Damian Lopez has been a director of the Company since September 26, 2017. Mr. Lopez is an executive and corporate lawyer with extensive M&A and corporate finance experience in the mining sector. Mr. Lopez holds a B.Comm. from University of Toronto and a J.D. from Osgoode Hall. His principal occupation is acting as a legal consultant to a variety of public and private companies (2015 to present), including serving as director and/or officer of several such companies. Previously, Mr. Lopez was a Corporate Associate at Stikeman Elliott LLP (2011 to 2015), a law firm, specializing in corporate and securities law.

Barry Greene, P.GEO. - VP Property Development & Director

Barry Greene was appointed as the Vice President, Property Development and Director on December 17, 2020. Mr. Greene is a Newfoundland-based geoscientist with over 30 years of experience including with multiple public companies and as a geological consultant. Mr. Greene has worked across Canada, in the United States and internationally for multi-national geological and engineering consulting companies like Amec Foster Wheeler, Wood Plc., BP Resources Canada, and Rio Algom Exploration Inc. He also previously served for 16 years as Exploration Manager and then Vice-President of Exploration for publicly-traded Celtic Minerals Ltd.

David Hladky, P.GEO. - Director

David Hladky is serving as a Director of the Company. Mr. Hladky is a registered geologist with over 22 years of hands-on international exploration experience including in Mexico, Canada, Argentina and Peru, including Project Manager and Qualified Person on the Morelos Sur and El Barqueno Projects in Mexico, purchased by Agnico Eagle Mines. Recently he has been working as a consultant for projects in Nevada, Ontario, and Mexico. He currently also serves as a Director for Infield Minerals Corp.

About TRU Precious Metals Corp.

TRU has assembled a portfolio of gold exploration properties in the Central Newfoundland Gold Belt, including its 100%-owned Twilite Gold Project located along the deposit-bearing Cape Ray - Valentine Lake Shear Zone. The Company's common shares trade on the TSX Venture Exchange under the symbol "TRU" and on the OTCQB Venture Market under the symbol "TRUIF".

TRU is a portfolio company of Resurgent Capital Corp. ("Resurgent"), a merchant bank providing venture capital markets advisory services and proprietary financing. Resurgent works with promising public and pre-public micro-capitalization Canadian companies. For more information on Resurgent and its portfolio companies, please visit Resurgent's LinkedIn profile at https://ca.linkedin.com/company/resurgent-capital-corp.

For further information, please contact:

Joel Freudman

Co-Founder, President & CEO

TRU Precious Metals Corp.

Phone: (647) 880-6414

Website: www.trupreciousmetals.com

Julie Hajduk

President and CEO

Purple Crown Communications Corp.

Phone: (604) 609-6169

Email: julie@purplecrown.ca

Website: https://purplecrown.ca/

To connect with TRU Precious Metals Corp. via social media, below are links:

Facebook

https://www.facebook.com/TRU-Precious-Metals-Corp-100919195193616

Twitter

https://twitter.com/corp_tru

Linkedin

https://www.linkedin.com/company/tru-precious-metals-corp

YouTube

https://www.youtube.com/channel/UCHghHMDQaYgS1rDHiZIeLUg/

Cautionary Statements Regarding Forward-Looking Information

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

The technical information herein relating to the Golden Rose Project has been supplied by Altius and has not been independently verified by TRU.

Information in this press release regarding Marathon Gold’s Valentine Gold Project and Matador Mining’s Cape Ray Gold Project have been taken from those respective companies’ websites, and has not been independently verified by the Company. These links are included in this press release as inactive textual references for reference purposes only and the information on or connected to these websites is not part of, or incorporated by reference into, this press release.

This press release contains certain forward-looking statements, including those relating to entering into the Option Agreement; acquiring, exploring, and monetizing the Golden Rose Project and the Company’s other mineral exploration properties; the application to and approval of the Exchange for the transactions contemplated herein; and potential financing activity by the Company. These statements are based on numerous assumptions regarding the Golden Rose Project and the Option that are believed by management to be reasonable in the circumstances, and are subject to a number of risks and uncertainties, including without limitation: mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Golden Rose Project; the exploration or monetization potential of the Golden Rose Project and the nature and style of mineralization at the Golden Rose Project; challenges in identifying, structuring, and executing additional investments and acquisitions, on favourable terms or at all; risks inherent in mineral exploration activities and investments in the mineral exploration sector; volatility in financial markets, economic conditions, and precious metals prices; and those other risks described in the Company’s continuous disclosure documents. Actual results may differ materially from results contemplated by the forward-looking statements herein. Investors and others should carefully consider the foregoing factors and should not place undue reliance on such forward-looking statements. The Company does not undertake to update any forward-looking statements herein except as required by applicable securities laws.

* https://www.sedar.com/DisplayCompanyDocuments.do?lang=EN&issuerNo=00009628

TRU Precious Metals signs binding term sheet with Altius Minerals subsidiary for option to purchase Golden Rose Project

Fredericton, New Brunswick – January 7, 2021 – TRU Precious Metals Corp. (TSXV:TRU; OTCQB:TRUIF) (“TRU” or the “Company”) is pleased to announce that it has entered into a binding term sheet with a subsidiary of TSX-listed Altius Minerals Corporation (TSX:ALS) (“Altius”) for the option (the “Option”) to purchase Altius’ Golden Rose project located in the southwestern portion of the Central Newfoundland Gold Belt (the “Golden Rose Project”).

Fredericton, New Brunswick – January 7, 2021 – TRU Precious Metals Corp. (TSXV:TRU; OTCQB:TRUIF) (“TRU” or the “Company”) is pleased to announce that it has entered into a binding term sheet with a subsidiary of TSX-listed Altius Minerals Corporation (TSX:ALS) (“Altius”) for the option (the “Option”) to purchase Altius’ Golden Rose project located in the southwestern portion of the Central Newfoundland Gold Belt (the “Golden Rose Project”).

TRU Co-Founder and CEO Joel Freudman commented: “We are thrilled to be partnering with Altius to explore and develop the Golden Rose Project. This partnership is consistent with our communicated strategy to build towards a district-scale presence in central Newfoundland.”

The Golden Rose Project is a regional-scale land package covering 105 kilometres squared (km2) within the Valentine Lake structural corridor, and is easily accessible via provincial highway and forest access roads. It is located between Marathon Gold Corp.’s (“Marathon”) Valentine Gold Project to the northeast, where Marathon has reported 3.09 million ounces (Moz.) Measured and Indicated gold (Au) resources (comprised of 54.9 million tonnes (Mt) at 1.75 grams per tonne (g/t) Au) + 0.96 Moz. Inferred Au resources (16.8 Mt at 1.78 g/t Au), and Matador Mining’s Cape Ray Gold Project to the southwest, which also has a known gold deposit.

Figure 1: Golden Rose Project Regional Location

Mr. Freudman added, “On closing, this transaction will bring Altius into TRU’s shareholder base as a strategic investor with an expected 19.9% stake. This is a pivotal development for us, as this fuels our rapid progress to date and further enhances TRU’s business prospects going forward. Coupled with our 100%-owned Twilite Gold Project, TRU will now have two highly-prospective gold exploration properties along a fault zone that hosts multiple known major deposits.”

Geological Description

The Valentine Lake structural corridor transects the full length of the Golden Rose Project, hosting over 45 km of prospective strike-length for Au mineralization.

In terms of top prospects, the South Woods Lake zone has yielded historical grab samples up to 65 g/t Au, and drill intercepts including 1.37 g/t Au over 26.31 metres (m) and 2.14 g/t Au over 16.11 m. To date, the zone has been outlined to greater than 550 m on surface and remains open along strike and at depth. Gold mineralization at the South Woods Lake zone is hosted by variably textured, sheared and brecciated, intrusive rock, and within of a network of thin, anastomosing, quartz–pyrite ±arsenopyrite veins and fractures. Preliminary work suggests the gold occurs as fine, free gold.

Altius has also identified no fewer than five other historic and newly discovered prospects at the Golden Rose Project, both north and south of South Woods Lake, including several at which historic high-grade unsourced quartz-rich float have been found. Float samples testing up to 196.7 g/t Au were found at the Falls Zone, which has exposed mineralization with anomalous gold grades, as well as samples at Glimmer Pond of up to 213.8 g/t Au, which has strongly altered volcanic or sedimentary rock on the southeast side of the pond with anomalous gold grades.

Figure 2: Golden Rose Project Historical Drilling at South Woods Lake Zone

The technical information herein, including assays, relating to the Golden Rose Project is historical in nature and has not been independently verified by TRU. Note that rock grab and float samples and drill hole intervals are selective by nature, and values reported may not represent the true grade or style of mineralization across the Golden Rose Project.

Terms of the Option Agreement

In order to acquire a 100% interest in the Golden Rose Project, the Company must issue such number of common shares in the capital of the Company (“TRU Shares”) as set forth below, and fund a total of $3,000,000 in exploration expenditures:

| Share Issuance | Exploration Funding Commitment |

|---|---|

|

7,115,000 TRU Shares, at a deemed price of $0.25 per Share, upon receipt of approval of the definitive agreement to be entered into in respect of the Option (the “Option Agreement”) from the TSX Venture Exchange (the “Exchange”) |

Nil |

| 800,000 TRU Shares on or before the date that is six (6) months from the date of the Option Agreement |

$500,000 by the first anniversary of the Option Agreement |

| 800,000 TRU Shares on or before the date that is eighteen (18) months from the date of the Option Agreement |

$1,000,000 by the second anniversary of the Option Agreement |

| 1,400,000 TRU Shares on or before the date that is twenty-four (24) months from the date of the Option Agreement |

$1,500,000 by the third anniversary of the Option Agreement |

Upon exercise of the Option, Altius will retain a 2.0% net smelter returns royalty from any future mineral production at the Golden Rose Project, subject to a proportionate reduction for any underlying royalty obligations held by third parties.

The transaction remains subject to regulatory approval by the Exchange, and to other conditions precedent including the preparation of a National Instrument 43-101 technical report in respect of the Golden Rose Project. Trading in the TRU Shares will remain halted pending further filings with the Exchange.

The parties are working on the preparation of the Option Agreement. In addition, TRU will start evaluating various equity financing options to fund its anticipated initial exploration commitment at the Golden Rose Project, along with the first phase of the Company’s intended drill program at the Twilite Gold Project.

Qualified Person

Barry Greene, P.Geo. is a qualified person as defined by National Instrument 43-101 and has reviewed and approved the contents and technical disclosures in this press release. Mr. Greene is a director and officer of the Company and owns securities of the Company.

About TRU Precious Metals Corp.

TRU seeks unique value-creation opportunities, and has assembled a portfolio of gold exploration properties in the Central Newfoundland Gold Belt. The Company’s common shares trade on the TSX Venture Exchange under the symbol “TRU” and on the OTCQB Venture Market under the symbol “TRUIF”.

TRU is a portfolio company of Resurgent Capital Corp. (“Resurgent”), a merchant bank providing venture capital markets advisory services and proprietary financing. Resurgent works with promising public and pre-public micro-capitalization Canadian companies. For more information on Resurgent and its portfolio companies, please visit Resurgent’s LinkedIn profile at https://ca.linkedin.com/company/resurgent-capital-corp.

For further information, please contact:

Joel Freudman

Co-Founder, President & CEO

TRU Precious Metals Corp.

Phone: (647) 880-6414

Website: www.trupreciousmetals.com

Julie Hajduk

President and CEO

Purple Crown Communications Corp.

Phone: (604) 609-6169

Email: julie@purplecrown.ca

Website: https://purplecrown.ca/

To connect with TRU Precious Metals Corp. via social media, below are links:

Facebook

https://www.facebook.com/TRU-Precious-Metals-Corp-100919195193616

Twitter

https://twitter.com/corp_tru

Linkedin

https://www.linkedin.com/company/tru-precious-metals-corp

YouTube

https://www.youtube.com/channel/UCHghHMDQaYgS1rDHiZIeLUg/

Cautionary Statements Regarding Forward-Looking Information

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

The technical information herein relating to the Golden Rose Project has been supplied by Altius and has not been independently verified by TRU.

Information in this press release regarding Marathon Gold’s Valentine Gold Project and Matador Mining’s Cape Ray Gold Project have been taken from those respective companies’ websites, and has not been independently verified by the Company. These links are included in this press release as inactive textual references for reference purposes only and the information on or connected to these websites is not part of, or incorporated by reference into, this press release.

This press release contains certain forward-looking statements, including those relating to entering into the Option Agreement; acquiring, exploring, and monetizing the Golden Rose Project and the Company’s other mineral exploration properties; the application to and approval of the Exchange for the transactions contemplated herein; and potential financing activity by the Company. These statements are based on numerous assumptions regarding the Golden Rose Project and the Option that are believed by management to be reasonable in the circumstances, and are subject to a number of risks and uncertainties, including without limitation: mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Golden Rose Project; the exploration or monetization potential of the Golden Rose Project and the nature and style of mineralization at the Golden Rose Project; challenges in identifying, structuring, and executing additional investments and acquisitions, on favourable terms or at all; risks inherent in mineral exploration activities and investments in the mineral exploration sector; volatility in financial markets, economic conditions, and precious metals prices; and those other risks described in the Company’s continuous disclosure documents. Actual results may differ materially from results contemplated by the forward-looking statements herein. Investors and others should carefully consider the foregoing factors and should not place undue reliance on such forward-looking statements. The Company does not undertake to update any forward-looking statements herein except as required by applicable securities laws.

TRU Precious Metals appoints Barry Greene, P.Geo. as Vice President, Property Development

Fredericton, New Brunswick – December 18, 2020 – TRU Precious Metals Corp. (TSXV: TRU) (OTCQB: TRUIF) (“TRU” or the “Company”) is pleased to announce that Barry Greene, P.Geo., who is currently the Company’s Exploration Advisor, has been appointed as Vice President, Property Development of the Company.

Fredericton, New Brunswick – December 18, 2020 – TRU Precious Metals Corp. (TSXV: TRU) (OTCQB: TRUIF) (“TRU” or the “Company”) is pleased to announce that Barry Greene, P.Geo., who is currently the Company’s Exploration Advisor, has been appointed as Vice President, Property Development of the Company. Mr. Greene will be instrumental in identifying potential property transactions and corporate M&A prospects, alongside overseeing exploration plans to enhance the value of the Company’s investment property portfolio in the Central Newfoundland Gold Belt. He will also remain a member of the Company’s Technical Committee.

A geoscientist with over 30 years of experience, Mr. Greene is based in Grand Falls-Windsor, Newfoundland, only 15 kilometers’ drive from TRU’s Twilite Gold Project. Mr. Greene has worked across Canada, in the United States and internationally for multi-national geological and engineering consulting companies like Amec Foster Wheeler, Wood Plc., BP Resources Canada, and Rio Algom Exploration Inc. He also previously served for 16 years as Exploration Manager and then Vice-President of Exploration for publicly-traded Celtic Minerals Ltd.

“We are delighted to welcome Barry as a key addition to our leadership team at TRU. Barry’s expansive technical background, connections in the Newfoundland mining industry, executive-level capital markets experience, and geographical proximity to 3 of our 4 properties are a rare package. He will be an ideal fit in a full-time role at TRU, and I am confident that in 2021 and beyond he will help us build shareholder value through a savvy combination of deals, development, and drilling,” stated Joel Freudman, Co-Founder and CEO of TRU.

Mr. Greene added: “I have been impressed with the TRU team’s performance, integrity, and culture since first getting involved in an advisory capacity. I look forward to helping the Company grow and monetize its various properties in the Central Newfoundland Gold Belt.”

Mr. Greene will also be joining TRU’s board of directors (the “Board”) in connection with his officer appointment. To facilitate Mr. Greene’s directorship without increasing the size of the Board, and in connection with the Company’s increased exposure to the mineral exploration industry, Marisa Muchnik has volunteered to depart from the Board.

Mr. Freudman added, “Marisa has provided top-notch advice and support relating to TRU’s non-mining holdings, while also bolstering the Company’s commitment to independent corporate governance. We are very grateful for her service to TRU, and wish her the best with her future endeavours.”

Finally, the Company announces that its CEO has issued a year-end letter to shareholders outlining the Company’s recent milestones and 2021 plans. A copy of the letter is available to all interested readers on the Company’s website at https://www.trupreciousmetals.com/s/TRU-Letter-to-Shareholders-December-2020.pdf.

About TRU Precious Metals Corp.

TRU seeks unique value-creation opportunities, and has assembled a portfolio of gold exploration properties in the Central Newfoundland Gold Belt. The Company’s common shares trade on the TSX Venture Exchange under the symbol “TRU”, and on the OTCQB Venture Market under the symbol “TRUIF”.

TRU is a portfolio company of Resurgent Capital Corp. (“Resurgent”), a merchant bank providing venture capital markets advisory services and proprietary financing. Resurgent works with promising public and pre-public micro-capitalization Canadian companies.

For further information, please contact:

Joel Freudman

Co-Founder, President & CEO

TRU Precious Metals Corp.

Phone: (647) 880-6414

Website: www.trupreciousmetals.com

Julie Hajduk

President and CEO

Purple Crown Communications Corp.

Phone: (604) 609-6169

Email: julie@purplecrown.ca

Website: https://purplecrown.ca/

To connect with TRU Precious Metals Corp. via social media, below are links:

Facebook

https://www.facebook.com/TRU-Precious-Metals-Corp-100919195193616

Twitter

https://twitter.com/corp_tru

Linkedin

https://www.linkedin.com/company/tru-precious-metals-corp

YouTube

https://www.youtube.com/channel/UCHghHMDQaYgS1rDHiZIeLUg/

Cautionary Statements Regarding Forward-Looking Information

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Information in this press release relating to New Found Gold, the Queensway Project and Fosterville Gold District are from sources believed to be reliable, but that have not been independently verified by TRU. The technical information herein relating to the Rolling Pond Property has been supplied by the Optionor and has not been independently verified by TRU.