TRU NEWS

All disclosure filings, including news releases and financial documents can be found on the TRU Precious Metals SEDAR page.

TRU Precious Metals completes change of business to mining issuer

Fredericton, New Brunswick – May 13, 2021 –TRU Precious Metals Corp. (TSXV:TRU; OTCQB:TRUIF) (“TRU” or the “Company”) is pleased to announce that further to its press releases issued on February 2, 2021 and April 30, 2021, the Company has completed its Change of Business (as such term is defined in TSX Venture Exchange (the “Exchange”) Policy 5.2) to a “mining issuer” from its current classification as an “investment issuer”.

Fredericton, New Brunswick – May 13, 2021 – TRU Precious Metals Corp. (TSXV:TRU; OTCQB:TRUIF) (“TRU” or the “Company”) is pleased to announce that further to its press releases issued on February 2, 2021 and April 30, 2021, the Company has completed its Change of Business (as such term is defined in TSX Venture Exchange (the “Exchange”) Policy 5.2) to a “mining issuer” from its current classification as an “investment issuer”.

In connection with the Change of Business and pursuant to Exchange requirements, the Company has filed a filing statement dated April 29, 2021 (the “Filing Statement”), together with a National Instrument 43-101 geological report on the Golden Rose Project (the “Geological Report”), under the Company’s SEDAR profile at www.sedar.com. Readers are strongly encouraged to review the Filing Statement and the Geological Report for full details on the Change of Business.

TRU Co-Founder and CEO Joel Freudman commented, “Today marks a seminal event for TRU. This is the outcome that we have been working towards over the past months: becoming a mining issuer. With our strong district-scale land package in the Central Newfoundland Gold Belt secured, having five properties within the region, we are well-positioned and well-funded to commence our various work programs. Once again, we thank all our loyal shareholders for their patience over these past months. We are excited to move forward with our business and exploration objectives, and to resume trading in our shares, so that we can grow TRU and continue to unlock value for our investors.”

The Company intends to resume trading on May 14, 2021. Upon resumption of trading, the Company will be listed on the Exchange as a Tier 2 “mining issuer”. The Company’s name and ticker symbol, “TRU”, will remain the same.

Further to its press release dated March 5, 2021, the Company is pleased to announce the release of funds held in escrow from its oversubscribed non-brokered private placement (the “Offering”) of gross proceeds of $3,500,212. Pursuant to the Offering, TRU issued 15,910,053 subscription receipts (the “Subscription Receipts”) at a price of $0.22 per Subscription Receipt. Each Subscription Receipt has been automatically exercised into one unit of the Company comprised of one (1) common share in the capital of the Company (each, a “Share”) and one (1) Share purchase warrant (each, a “Warrant”), with each Warrant entitling the holder thereof to purchase one Share at a price of $0.35 for a period of 36 months following the date of closing of the Offering. Eligible finders received, on account of gross proceeds raised from subscribers to the Offering who were introduced by such finders, (a) a cash commission equal to an aggregate of approximately $115,777, and (b) an aggregate of 526,257 non-transferrable finder warrants, each of which will entitle the holder thereof to purchase one Share at a price of $0.22 for a period of 36 months following the closing date of the Offering.

About TRU Precious Metals Corp.

TRU has assembled a portfolio of 5 gold exploration properties in the highly prospective Central Newfoundland Gold Belt. The Company has entered into a definitive option agreement with a subsidiary of TSX-listed Altius Minerals Corporation for the option to purchase 100% of the Golden Rose Project, located along the deposit-bearing Cape Ray – Valentine Lake Shear Zone. TRU also owns 100% of the Twilite Gold Project, located along the same Shear Zone, and 3 under-explored properties including its Rolling Pond Property (under option) bordering New Found Gold Corp.’s high-grade Queensway Project. TRU’s common shares trade on the TSX Venture Exchange under the symbol “TRU” and on the OTCQB Venture Market under the symbol “TRUIF”.

TRU is a portfolio company of Resurgent Capital Corp. (“Resurgent”), a merchant bank providing venture capital markets advisory services and proprietary financing. Resurgent works with promising public and pre-public micro-capitalization Canadian companies. For more information on Resurgent and its portfolio companies, please visit Resurgent’s LinkedIn profile at https://ca.linkedin.com/company/resurgent-capital-corp.

For further information about TRU, please contact:

Joel Freudman

Co-Founder, President & CEO

TRU Precious Metals Corp.

Phone: (647) 880-6414

Email: info@trupreciousmetals.com

Website: www.trupreciousmetals.com

To connect with TRU via social media, below are links:

Facebook

https://www.facebook.com/TRU-Precious-Metals-Corp-100919195193616

Twitter

https://twitter.com/corp_tru

LinkedIn

https://www.linkedin.com/company/tru-precious-metals-corp

YouTube

https://www.youtube.com/channel/UCHghHMDQaYgS1rDHiZIeLUg/

Cautionary Statements

Neither the Exchange nor its Regulation Services Provider (as that term is defined in policies of the Exchange) accepts responsibility for the adequacy or accuracy of this press release.

This press release contains “forward-looking information” within the meaning of applicable Canadian securities laws. Generally, forward-looking information can be identified by the use of words and phrases such as “plans”, “expects”, “continues”, “intends”, “anticipates”, or “believes”, or variations of such words and phrases indicating that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken or occur. Forward-looking information in this press release includes, without limitation, statements regarding resumption of trading of the Shares on the Exchange and TRU’s exploration plans and corporate strategy. This forward-looking information consists of disclosure regarding possible events, conditions or results and is based on numerous assumptions that management believes to be reasonable in the circumstances, including that TRU will be able to successfully execute on its corporate and exploration plans.

The forward-looking information in this press release is subject to a number of risks and uncertainties that may cause TRU’s actual results or performance to differ materially from those expressed or implied by such forward-looking information, including but not limited to risks inherent to the mineral exploration industry, and those risks described in the Company’s continuous disclosure documents. There can be no assurances that the forward-looking information herein will prove to be accurate, as actual results and future events may differ materially from those anticipated by such information. Accordingly, investors should not place undue reliance on such forward-looking information. TRU does not undertake to update any forward-looking information in this press release, except as required by applicable securities laws.

TRU Precious Metals closes option agreement with subsidiary of Altius Minerals to purchase Golden Rose Project

Fredericton, New Brunswick – May 12, 2021 –TRU Precious Metals Corp. (TSXV:TRU; OTCQB:TRUIF) (“TRU” or the “Company”) is pleased to announce that it has closed the option agreement dated February 23, 2021 (the “Option Agreement”) with a subsidiary of TSX-listed Altius Minerals Corporation (TSX:ALS) (“Altius”) to purchase Altius’ Golden Rose Project (as defined below).

Fredericton, New Brunswick – May 12, 2021 –TRU Precious Metals Corp. (TSXV:TRU; OTCQB:TRUIF) (“TRU” or the “Company”) is pleased to announce that it has closed the option agreement dated February 23, 2021 (the “Option Agreement”) with a subsidiary of TSX-listed Altius Minerals Corporation (TSX:ALS) (“Altius”) to purchase Altius’ Golden Rose Project (as defined below). This is further to the Company’s press releases dated January 7, 2021, February 2, 2021 and February 24, 2021.

TRU Co-Founder and CEO Joel Freudman commented: “We are delighted to welcome Altius as a strategic investor to TRU, as our largest shareholder. Our partnership to explore and develop the Golden Rose Project is an integral component of TRU’s growth trajectory. This transaction propelled TRU to its Change of Business to a mining issuer, for which we received conditional approval from the TSX Venture Exchange on April 30, 2021, and will be completing imminently. Having also raised $3.5 million to fund work on the Golden Rose Project and our other projects, as well as a variety of public company initiatives, we are excited about the evolution of TRU to an exploration and mining company.”

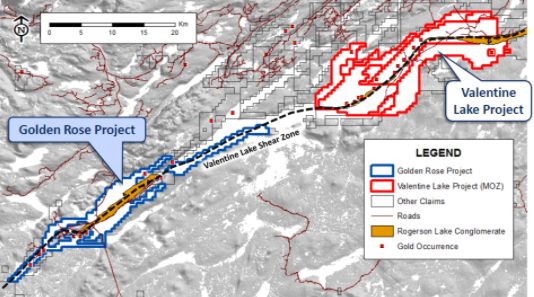

Golden Rose Project

The Golden Rose Project is a regional-scale land package covering 105 km² within the Valentine Lake structural corridor, and is easily accessible via provincial highway and forest access roads. It is located between Marathon Gold Corp.’s Valentine Gold Project to the northeast and Matador Mining Ltd.’s Cape Ray Gold Project to the southwest.

Figure 1: Golden Rose Project Regional Location

In terms of top prospects, the South Woods Lake zone has yielded historical grab samples up to 65 grams per ton (g/t) of gold (Au), and drill intercepts including 1.37 g/t Au over 26.31 metres (m) and 2.14 g/t Au over 16.11 m. To date, the zone has been outlined to greater than 550 m on surface and remains open along strike and at depth. Gold mineralization at the South Woods Lake zone is hosted by variably textured, sheared and brecciated, intrusive rock, and within of a network of thin, anastomosing, quartz–pyrite ±arsenopyrite veins and fractures. Preliminary work suggests the gold occurs as fine, free gold.

Altius has also identified no fewer than five other historic and newly discovered prospects at the Golden Rose Project, both north and south of South Woods Lake, including several at which historic high-grade unsourced quartz-rich float have been found. Float samples testing up to 196.7 g/t Au were found at the Falls Zone, which has exposed mineralization with anomalous gold grades, as well as samples at Glimmer Pond of up to 213.8 g/t Au, which has strongly altered volcanic or sedimentary rock on the southeast side of the pond with anomalous gold grades.

Figure 2: Golden Rose Project Historical Drilling at South Woods Lake Zone

Mr. Freudman added, “With the recent flurry of positive exploration results and financing announcements coming from our neighbours in the Central Newfoundland Gold Belt, including most prominently New Found Gold and Marathon Gold, we are eager to begin working not only our Golden Rose Project but also our other projects located within this prolific gold region. With our commanding land position, market conditions that are highly favourable, and a plethora of great news coming from those neighbours and others like Sokoman Minerals and Canterra Minerals, we believe that we are in the right place at the right time.”

Terms of the Option Agreement

Pursuant to the Option Agreement, Altius has granted TRU the exclusive right and option (the “Option”) to acquire, subject to retention by Altius of a maximum 2.0% net smelter return (“NSR”) royalty, its 100% interest in a package of mineral claims located in the southwestern portion of the Central Newfoundland Gold Belt (the “Altius Claims”). Altius has also assigned an existing option agreement (the “Rose Gold Agreement”, and together with the Option Agreement, collectively, the “Transaction”) under which Shawn Rose (the “Rose Optionor”) has granted the exclusive right and option to acquire, subject to retention by the Rose Optionor of a royalty, his 100% interest in certain surrounding mineral claims known as the Rose Gold claims (the “Rose Gold Claims”). Collectively, the Altius Claims and the Rose Gold Claims are called the “Golden Rose Project”.

In order to acquire a 100% interest in the Golden Rose Project, the Company must issue such number of common shares in the capital of TRU (“TRU Shares”) as set forth below, and fund a total of $3,000,000 in exploration expenditures:

| Date | TRU Share Issuance | Exploration Funding Commitment |

|---|---|---|

| Completed on May 11, 2021 | 7,140,000 TRU Shares, at a deemed price of $0.25 per TRU Share |

Nil |

| Within one month from May 11, 2021 |

800,000 TRU shares, at a deemed price of $0.25 per TRU share |

Nil |

| By February 23, 2022 | 800,000 TRU Shares, at a deemed price of $0.25 per TRU Share |

$500,000 |

| By February 23, 2023 | 1,400,000 TRU Shares, at a deemed price of $0.25 per TRU share |

An additional $1,000,000 |

| By February 23, 2024 | Nil | An additional $1,500,000 |

In addition, TRU must pay the Rose Optionor: (i) $22,500, in cash or by issuance of TRU Shares, at the election of the Rose Optionor, on November 30, 2021; and (ii) $37,500, in cash or by issuance of TRU Shares, at the election of the Rose Optionor, on November 30, 2022. The deemed value of such TRU Shares, if issued in lieu of cash, shall be the greater of (a) $0.25 per TRU Share and (b) the closing price of such TRU Shares on the TSX Venture Exchange (the “Exchange”), on the day prior to such payment date.

TRU will also have to pay the Rose Optionor a $250,000 cash bonus if TRU defines at least 1,000,000 ounces of gold on the Rose Gold Claims in the Measured & Indicated categories of a National Instrument 43-101 mineral resource estimate. TRU shall also grant the Rose Optionor a 2.0% NSR on any future mineral production at the Rose Gold Claims.

Additional terms of the Option Agreement can be found in the Company’s press release dated February 24, 2021.

National Instrument 43-101 Disclosures

The technical information herein, including assays, relating to the Golden Rose Project is historical in nature and has not been independently verified by TRU. Note that rock grab and float samples and drill hole intervals are selective by nature, and values reported may not represent the true grade or style of mineralization across the Golden Rose Project. A complete technical description of the Golden Rose Project is available in the technical report for the Golden Rose Project dated March 31, 2021, which is available on the Company’s SEDAR profile at www.sedar.com.

Barry Greene, P.Geo. is a qualified person as defined by National Instrument 43-101 and has reviewed and approved the contents and technical disclosures in this press release. Mr. Greene is a director and officer of the Company and owns securities of the Company.

About TRU Precious Metals Corp.

TRU has assembled a portfolio of 5 gold exploration properties in the highly prospective Central Newfoundland Gold Belt. The Company has an option to purchase 100% of the Golden Rose Project, located along the deposit-bearing Cape Ray – Valentine Lake Shear Zone, from a subsidiary of TSX-listed Altius Minerals Corporation. TRU also owns 100% of the Twilite Gold Project, located along the same Shear Zone, and 3 under-explored properties including its Rolling Pond Property (under option) bordering New Found Gold Corp.’s high-grade Queensway Project. TRU’s common shares trade on the TSX Venture Exchange under the symbol “TRU” and on the OTCQB Venture Market under the symbol “TRUIF”.

TRU is a portfolio company of Resurgent Capital Corp. (“Resurgent”), a merchant bank providing venture capital markets advisory services and proprietary financing. Resurgent works with promising public and pre-public micro-capitalization Canadian companies. For more information on Resurgent and its portfolio companies, please visit Resurgent’s LinkedIn profile at https://ca.linkedin.com/company/resurgent-capital-corp.

For further information about TRU, please contact:

Joel Freudman

Co-Founder, President & CEO

TRU Precious Metals Corp.

Phone: (647) 880-6414

Email: info@trupreciousmetals.com

Website: www.trupreciousmetals.com

To connect with TRU via social media, below are links:

Facebook

https://www.facebook.com/TRU-Precious-Metals-Corp-100919195193616

Twitter

https://twitter.com/corp_tru

LinkedIn

https://www.linkedin.com/company/tru-precious-metals-corp

YouTube

https://www.youtube.com/channel/UCHghHMDQaYgS1rDHiZIeLUg/

Cautionary Statements

Neither the Exchange nor its Regulation Services Provider (as that term is defined in policies of the Exchange) accepts responsibility for the adequacy or accuracy of this press release.

This press release contains certain forward-looking statements, including those relating to completion of the Company’s Change of Business, corporate strategy and plans, use of financing proceeds, and the outlook for the gold sector. These statements are based on numerous assumptions regarding the Golden Rose Project and the Company’s prospects that are believed by management to be reasonable in the circumstances, and are subject to a number of risks and uncertainties, including without limitation: mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Golden Rose Project; the exploration or monetization potential of the Golden Rose Project and the nature and style of mineralization at the Golden Rose Project; challenges in identifying, structuring, and executing transactions on favourable terms or at all; risks inherent in mineral exploration activities; volatility in financial markets, economic conditions, and precious metals prices; and those other risks described in the Company’s continuous disclosure documents. Actual results may differ materially from results contemplated by the forward-looking statements herein. Investors and others should carefully consider the foregoing factors and should not place undue reliance on such forward-looking statements. The Company does not undertake to update any forward-looking statements herein except as required by applicable securities laws.

TRU Precious Metals obtains conditional approval for TSX Venture Exchange change of business to mining issuer

Fredericton, New Brunswick – April 30, 2021 –TRU Precious Metals Corp. (TSXV:TRU; OTCQB:TRUIF) (“TRU” or the “Company”) is pleased to announce that further to its press release on February 2, 2021, the Company has received conditional approval from the TSX Venture Exchange (the “Exchange”) for a Change of Business (as such term is defined in Exchange Policy 5.2) to a “mining issuer” from its current classification as an “investment issuer”.

Fredericton, New Brunswick – April 30, 2021 –TRU Precious Metals Corp. (TSXV:TRU; OTCQB:TRUIF) (“TRU” or the “Company”) is pleased to announce that further to its press release on February 2, 2021, the Company has received conditional approval from the TSX Venture Exchange (the “Exchange”) for a Change of Business (as such term is defined in Exchange Policy 5.2) to a “mining issuer” from its current classification as an “investment issuer”.

In connection with the Change of Business and pursuant to Exchange requirements, the Company has filed a filing statement dated April 29, 2021 (the “Filing Statement”), together with a National Instrument 43-101 geological report on the Golden Rose Project (the “Geological Report”), under the Company’s SEDAR profile at www.sedar.com. Readers are strongly encouraged to review the Filing Statement and the Geological Report for full details on the Change of Business.

TRU Co-Founder and CEO Joel Freudman commented, “Today marks an important milestone for our Company. We filed our initial comprehensive submission with the Exchange in early March shortly after completing our financing, and have aggressively advanced the Change of Business since, with thanks to the attentiveness and solutions-oriented approach of the Exchange, to secure conditional approval of our Change of Business in less than two months.”

The Company intends to complete the Change of Business and resume trading the week of May 10, 2021. The completion of the Change of Business remains subject to final approval by the Exchange and fulfillment of Exchange requirements, including among other things, obtaining shareholder approval of the Change of Business by way of written consents. Until final approval is obtained and a Final Exchange Bulletin is issued, trading in the common shares of the Company will remain halted. Upon resumption of trading, the Company will be listed on the Exchange as a Tier 2 “mining issuer”. The Company’s name and ticker symbol, “TRU”, will remain the same.

Mr. Freudman added, “Alongside the Change of Business, we have been hard at work mapping out our 2021 exploration programs and building an exploration team to position TRU as a contender in the prolific Central Newfoundland Gold Belt. Having recently closed an over-subscribed $3.5 million non-brokered private placement, we are well-funded for our near-term exploration plans for our Golden Rose Project as well as other initiatives, all aimed at unlocking value for our shareholders. I would like to thank all our loyal shareholders, old and new, yet again for their continued patience, and we are looking forward to resuming trading in the near term.”

Separately, the Company reports that further to its March 1, 2021 press release, the Company continues to receive punctual principal and interest repayments on its secured loan (the “Loan”) previously advanced in March 2020 to Revive Organics Inc., a private company operating across North America in the ready-to-eat meals industry. The Loan remains in good standing and on April 29, 2021, the Company received a payment of $223,500, one day before it was due. With that payment, the Company has now been repaid nearly all of this legacy investment, which matures in full on May 31, 2021 with a final $222,667 lump-sum payment of principal, interest, and fees, as TRU completes its transition to a mining issuer.

About TRU Precious Metals Corp.

TRU has assembled a portfolio of 5 gold exploration properties in the highly prospective Central Newfoundland Gold Belt. The Company has entered into a definitive option agreement with a subsidiary of TSX-listed Altius Minerals Corporation for the option to purchase 100% of the Golden Rose Project, located along the deposit-bearing Cape Ray – Valentine Lake Shear Zone. TRU also owns 100% of the Twilite Gold Project, located along the same Shear Zone, and 3 under-explored properties including its Rolling Pond Property (under option) bordering New Found Gold Corp.’s high-grade Queensway Project. TRU’s common shares trade on the TSX Venture Exchange under the symbol “TRU” and on the OTCQB Venture Market under the symbol “TRUIF”.

TRU is a portfolio company of Resurgent Capital Corp. (“Resurgent”), a merchant bank providing venture capital markets advisory services and proprietary financing. Resurgent works with promising public and pre-public micro-capitalization Canadian companies. For more information on Resurgent and its portfolio companies, please visit Resurgent’s LinkedIn profile at https://ca.linkedin.com/company/resurgent-capital-corp.

For further information about TRU, please contact:

Joel Freudman

Co-Founder, President & CEO

TRU Precious Metals Corp.

Phone: (647) 880-6414

Email: info@trupreciousmetals.com

Website: www.trupreciousmetals.com

To connect with TRU via social media, below are links:

Facebook

https://www.facebook.com/TRU-Precious-Metals-Corp-100919195193616

Twitter

https://twitter.com/corp_tru

LinkedIn

https://www.linkedin.com/company/tru-precious-metals-corp

YouTube

https://www.youtube.com/channel/UCHghHMDQaYgS1rDHiZIeLUg/

Cautionary Statements

Neither the Exchange nor its Regulation Services Provider (as that term is defined in policies of the Exchange) accepts responsibility for the adequacy or accuracy of this press release.

This press release contains “forward-looking information” within the meaning of applicable Canadian securities laws. Generally, forward-looking information can be identified by the use of words and phrases such as “plans”, “expects”, “continues”, “intends”, “anticipates”, or “believes”, or variations of such words and phrases indicating that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken or occur. Forward-looking information in this press release includes, without limitation, statements regarding Exchange final approval of the Change of Business, shareholder approval of the Change of Business, resumption of trading of TRU’s common shares on the Exchange, TRU’s exploration plans and corporate strategy, and future Loan repayment. This forward-looking information consists of disclosure regarding possible events, conditions or results and is based on numerous assumptions that management believes to be reasonable in the circumstances, including that Exchange final approval will be obtained and that TRU will be able to successfully execute on its corporate and exploration plans.

The forward-looking information in this press release is subject to a number of risks and uncertainties that may cause TRU’s actual results or performance to differ materially from those expressed or implied by such forward-looking information, including but not limited to shareholder and regulatory approval processes, risks inherent to the mineral exploration industry, borrower counterparty risk of default, and those risks described in the Company’s continuous disclosure documents. There can be no assurances that the forward-looking information herein will prove to be accurate, as actual results and future events may differ materially from those anticipated by such information. Accordingly, investors should not place undue reliance on such forward-looking information. TRU does not undertake to update any forward-looking information in this press release, except as required by applicable securities laws.

GoldSpot Discoveries to Apply Artificial Intelligence to TRU Precious Metals Corp. Newfoundland Properties

Toronto, Ontario--(Newsfile Corp. - April 14, 2021) - GoldSpot Discoveries Corp. (TSXV: SPOT) (“GoldSpot” or the “Company“) is pleased to announce it has been engaged by TRU Precious Metals Corp. (TSXV: TRU) (“TRU”) to apply its proprietary machine learning technology and geoscience expertise on TRU’s Golden Rose and Twilite Gold projects, located in the prolific Central Newfoundland Gold Belt.

Toronto, Ontario--(Newsfile Corp. - April 14, 2021) - GoldSpot Discoveries Corp. (TSXV: SPOT) (“GoldSpot” or the “Company“) is pleased to announce it has been engaged by TRU Precious Metals Corp. (TSXV: TRU) (“TRU”) to apply its proprietary machine learning technology and geoscience expertise on TRU’s Golden Rose and Twilite Gold projects, located in the prolific Central Newfoundland Gold Belt. GoldSpot will bring its proven Artificial Intelligence (“AI”) expertise that has led to important mineral discoveries in the province to TRU’s exploration projects.

GoldSpot is a technology company focused on developing AI and other technology for the mining and exploration sector. GoldSpot is working with some of the leading exploration and mining names in the industry to apply cutting edge AI algorithms to significantly increase the efficiency and success rate of mineral exploration. Recent successes by GoldSpot with both leading producers and explorer/developers have demonstrated the potential to expand resources and make new discoveries using this advanced analytical technology.

Denis Laviolette, Executive Chairman and President of GoldSpot, stated: “We are excited to bring our technology back to Newfoundland where we built tremendous expertise over the years. As the premier geological and data partner in the province, GoldSpot has worked with multiple exploration companies and their management teams to drive results. We are confident we will help TRU capitalize on their existing infrastructure and exploration potential to identify new discoveries on their properties.”

Joel Freudman, President and CEO of TRU Precious Metals, commented: "We are delighted to partner with GoldSpot, a company with a stellar reputation and highly-experienced technical team. We look forward to drawing on their AI technologies to target and accelerate our exploration program, particularly at our Golden Rose Project along the deposit-bearing Cape Ray - Valentine Lake Shear Zone. Having recently closed an over-subscribed $3.5 million financing, we are excited to begin work in earnest on our district-scale land package in the Central Newfoundland Gold Belt."

About GoldSpot Discoveries Corp.

GoldSpot Discoveries Corp. (TSXV: SPOT) is a technology services company in mineral exploration. GoldSpot is a leading team of expert scientists who merge geoscience and data science to deliver bespoke solutions that transform the mineral discovery process. In the race to make discoveries, GoldSpot produces Smart Targets and advanced geological modelling that saves times, reduces costs, and provides accurate results.

About TRU Precious Metals Corp.

TRU has assembled a portfolio of 5 gold exploration properties in the highly prospective Central Newfoundland Gold Belt. The Company has entered into a definitive option agreement with a subsidiary of TSX-listed Altius Minerals Corporation for the option to purchase 100% of the Golden Rose Project, located along the deposit-bearing Cape Ray – Valentine Lake Shear Zone. TRU also owns 100% of the Twilite Gold Project, located along the same Shear Zone, and 3 under-explored properties including its Rolling Pond Property (under option) bordering New Found Gold Corp.’s high-grade Queensway Project. TRU’s common shares trade on the TSX Venture Exchange under the symbol “TRU” and on the OTCQB Venture Market under the symbol “TRUIF”.

For further information, please contact:

Denis Laviolette

Executive Chairman and President

GoldSpot Discoveries Corp.

Tel: 647-992-9837

Email: investors@goldspot.ca

Cautionary Statements

Neither the TSX Venture Exchange ("TSXV") nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this release.

No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein. This news release contains forward-looking information which involves risks, uncertainties and other factors that could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward-looking information in this news release includes, but is not limited to, the Company's objectives, goals or future plans, statements regarding exploration results and exploration plans. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to, capital and operating costs varying significantly from estimates, the preliminary nature of metallurgical test results, delays in obtaining or failures to obtain required governmental, environmental or other project approvals, uncertainties relating to the availability and costs of financing needed in the future, changes in equity markets, inflation, fluctuations in commodity prices, delays in the development of projects and the other risks involved in the mineral exploration and development industry, and those risks set out in the Company's public documents filed on SEDAR. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.

TRU Precious Metals hires Pearce Bradley, P.Geo. as exploration manager

Fredericton, New Brunswick– March 23, 2021 –TRU Precious Metals Corp. (TSXV:TRU; OTCQB:TRUIF) (“TRU” or the “Company”) is pleased to announce that the Company has hired Pearce Bradley, BSc, P.Geo. as Exploration Manager for the Company’s district-scale property portfolio in the Central Newfoundland Gold Belt.

Fredericton, New Brunswick – March 23, 2021 – TRU Precious Metals Corp. (TSXV:TRU; OTCQB:TRUIF) (“TRU” or the “Company”) is pleased to announce that the Company has hired Pearce Bradley, BSc, P.Geo. as Exploration Manager for the Company’s district-scale property portfolio in the Central Newfoundland Gold Belt. Mr. Bradley will oversee the planning, managing, and overall implementation of the Company’s mineral exploration programs, working closely with the Company’s Vice President of Property Development, Barry Greene, P.Geo.

A geologist with over 35 years’ experience, Mr. Bradley has worked across Canada in multiple roles in mineral exploration, mining, geotechnical and wellsite geology. He has performed many leadership and project management functions in each of these aspects, with a significant focus on Newfoundland exploration and mining development projects. Mr. Bradley most recently worked for Maritime Resources Corp. on its Hammerdown and Whisker Valley gold projects in the Baie Verte-Springdale Mining District in Newfoundland.

TRU Co-Founder and CEO Joel Freudman commented, “I am delighted to welcome Pearce to TRU. He is an excellent choice as our Exploration Manager, bringing a wealth of geological knowledge of Newfoundland. Pearce also has familiarity with the mine development process, both open pit and underground, from his prior employment with numerous gold and copper mining projects in Newfoundland. Pearce’s addition further amplifies our exploration team, to which we have also just added a Field Geologist for the 2021 exploration season. With TRU’s recent over-subscribed $3.5 million financing closed earlier this month, and the ongoing build-out of our team, TRU is increasingly well-positioned to unlock value for our enlarged shareholder base.”

TRU Exploration Manager Pearce Bradley added: “I am very excited about this opportunity to work with TRU on its exploration projects within the Central Newfoundland Gold Belt, including the Company’s flagship Golden Rose Project. I look forward to helping the entire team advance and build on the work that has already been done in amassing a promising land package in the region, and contributing to TRU’s systematic approach to its current and future exploration projects.”

The Company also wishes to provide an update that it continues to work with the TSX Venture Exchange (the “Exchange”) in order to complete its Change of Business (as defined in Exchange policies) as expeditiously as possible, and thereafter to resume the trading of the Company’s common shares on the Exchange. The Company filed its comprehensive submission with the Exchange in mid-March, and will provide a further update in this regard when there is any material development.

About TRU Precious Metals Corp.

TRU has assembled a portfolio of 5 gold exploration properties in the highly prospective Central Newfoundland Gold Belt. The Company has entered into a definitive option agreement with a subsidiary of TSX-listed Altius Minerals Corporation for the option to purchase 100% of the Golden Rose Project, located along the deposit-bearing Cape Ray – Valentine Lake Shear Zone. TRU also owns 100% of the Twilite Gold Project, located along the same Shear Zone, and 3 under-explored properties including its Rolling Pond Property (under option) bordering New Found Gold Corp.’s high-grade Queensway Project. TRU’s common shares trade on the TSX Venture Exchange under the symbol “TRU” and on the OTCQB Venture Market under the symbol “TRUIF”.

TRU is a portfolio company of Resurgent Capital Corp. (“Resurgent”), a merchant bank providing venture capital markets advisory services and proprietary financing. Resurgent works with promising public and pre-public micro-capitalization Canadian companies. For more information on Resurgent and its portfolio companies, please visit Resurgent’s LinkedIn profile at https://ca.linkedin.com/company/resurgent-capital-corp.

For further information, please contact:

Joel Freudman

Co-Founder, President & CEO

TRU Precious Metals Corp.

Phone: (647) 880-6414

Email: info@trupreciousmetals.com

Website: www.trupreciousmetals.com

To connect with TRU via social media, below are links:

Facebook

https://www.facebook.com/TRU-Precious-Metals-Corp-100919195193616

Twitter

https://twitter.com/corp_tru

LinkedIn

https://www.linkedin.com/company/tru-precious-metals-corp

YouTube

https://www.youtube.com/channel/UCHghHMDQaYgS1rDHiZIeLUg/

Cautionary Statements

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this press release.

This press release contains certain forward-looking statements, including those relating to Mr. Bradley’s expected contributions to the Company; the Company’s corporate strategy, and hiring and exploration plans; and the Change of Business. These statements are based on numerous assumptions regarding, among other things, Mr. Bradley’s involvement, the Company’s prospects, and Exchange review processes, that are believed by management to be reasonable in the circumstances, and are subject to a number of risks and uncertainties, including without limitation: challenges in recruiting and retaining qualified personnel; the exploration or monetization potential of the Company’s mineral properties; risks inherent in mineral exploration activities; regulatory approval processes; volatility in financial markets, economic conditions, and precious metals prices; and those other risks described in the Company’s continuous disclosure documents. Actual results may differ materially from results contemplated by the forward-looking statements herein. Investors and others should carefully consider the foregoing factors and should not place undue reliance on such forward-looking statements. The Company does not undertake to update any forward-looking statements herein except as required by applicable securities laws.

TRU Precious Metals engages HE Capital for North American digital advertising campaign

Fredericton, New Brunswick – March 10, 2021 – TRU Precious Metals Corp. (TSXV: TRU) (OTCQB: TRUIF) (“TRU” or the “Company”) is pleased to announce that, subject to regulatory approval, it has engaged HE Capital Markets Ltd. (“HE”) to design and implement a North American multimedia digital advertising campaign for TRU on certain investor-focused and financial market websites.

Fredericton, New Brunswick – March 10, 2021 – TRU Precious Metals Corp. (TSXV: TRU) (OTCQB: TRUIF) (“TRU” or the “Company”) is pleased to announce that, subject to regulatory approval, it has engaged HE Capital Markets Ltd. (“HE”) to design and implement a North American multimedia digital advertising campaign for TRU on certain investor-focused and financial market websites. HE will also provide other media communications services to raise the Company’s overall corporate profile in North America.

The cash consideration to be paid by the Company for these services consists of US$30,000 for a three-month campaign commencing on April 15, 2021, and US$10,000 for a parallel one-month campaign commencing on May 1, 2021.

HE acts at arm’s length to TRU and do not currently have any interest, directly or indirectly, in the Company or its securities. HE may choose to acquire securities of TRU in the future.

About HE Capital Markets Ltd.

HE is a London-based investor relations and capital markets advisory firm, providing comprehensive communications solutions to public company clients in North America and Europe through a combination of investor relations, public relations, and digital and social media services. HE’s office address is 6 Hays Lane, London Bridge, London, SE1 2HB, United Kingdom.

About TRU Precious Metals Corp.

TRU has assembled a portfolio of 5 gold exploration properties in the highly prospective Central Newfoundland Gold Belt. The Company has entered into a definitive option agreement with a subsidiary of TSX-listed Altius Minerals Corporation for the option to purchase 100% of the Golden Rose Project, located along the deposit-bearing Cape Ray – Valentine Lake Shear Zone. TRU also owns 100% of the Twilite Gold Project, located along the same Shear Zone, and 3 under-explored properties including its Rolling Pond Property (under option) bordering New Found Gold Corp.’s high-grade Queensway Project. TRU’s common shares trade on the TSX Venture Exchange under the symbol “TRU” and on the OTCQB Venture Market under the symbol “TRUIF”.

TRU is a portfolio company of Resurgent Capital Corp. (“Resurgent”), a merchant bank providing venture capital markets advisory services and proprietary financing. Resurgent works with promising public and pre-public micro-capitalization Canadian companies. For more information on Resurgent and its portfolio companies, please visit Resurgent’s LinkedIn profile at https://ca.linkedin.com/company/resurgent-capital-corp.

For further information, please contact:

Joel Freudman

Co-Founder, President & CEO

TRU Precious Metals Corp.

Phone: (647) 880-6414

Email: info@trupreciousmetals.com

Website: www.trupreciousmetals.com

To connect with TRU via social media, below are links:

Facebook

https://www.facebook.com/TRU-Precious-Metals-Corp-100919195193616

Twitter

https://twitter.com/corp_tru

LinkedIn

https://www.linkedin.com/company/tru-precious-metals-corp

YouTube

https://www.youtube.com/channel/UCHghHMDQaYgS1rDHiZIeLUg/

Cautionary Statements

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This press release contains certain forward-looking statements, including those relating to regulatory approval and the Company’s ongoing relationship with HE. These statements are based on numerous assumptions regarding the Company’s corporate and investor relations strategies that are believed by management to be reasonable in the circumstances, and are subject to a number of risks and uncertainties, including without limitation: regulatory approval processes; challenges in attracting and retaining qualified personnel; volatility in financial markets, economic conditions, and precious metals prices; and those other risks described in the Company’s continuous disclosure documents. Actual results may differ materially from results contemplated by the forward-looking statements herein. Investors and others should carefully consider the foregoing factors and should not place undue reliance on such forward-looking statements. The Company does not undertake to update any forward-looking statements herein except as required by applicable securities laws.

TRU Precious Metals completes oversubscribed private placement of subscription receipts for gross proceeds of $3.5 Million with a lead order from Palisades Goldcorp

Fredericton, New Brunswick – March 5, 2021 – Further to its press releases dated February 16, 2021 and March 1, 2021, TRU Precious Metals Corp. (TSXV:TRU; OTCQB:TRUIF) (“TRU” or the “Company”) is pleased to announce that it has completed its oversubscribed non-brokered private placement (the “Offering”) for gross proceeds of $3,500,211.66, with a lead order from Palisades Goldcorp Ltd. (“Palisades”).

THIS NEWS RELEASE IS NOT INTENDED FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

Fredericton, New Brunswick – March 5, 2021 – Further to its press releases dated February 16, 2021 and March 1, 2021, TRU Precious Metals Corp. (TSXV:TRU; OTCQB:TRUIF) (“TRU” or the “Company”) is pleased to announce that it has completed its oversubscribed non-brokered private placement (the “Offering”) for gross proceeds of $3,500,211.66, with a lead order from Palisades Goldcorp Ltd. (“Palisades”). Pursuant to the Offering, TRU issued 15,910,053 subscription receipts (the "Subscription Receipts") at a price of $0.22 per Subscription Receipt. The Offering is subject to the final approval of the TSX Venture Exchange (the “Exchange”).

TRU Co-Founder and CEO Joel Freudman commented, “By successfully completing this Offering, we have secured the funds to finance our comprehensive exploration program in the Central Newfoundland Gold Belt on our Golden Rose Project as well as a defined phase 1 drilling program at our 100 percent owned Twilite Gold Project. Notwithstanding some headwinds from a consolidating gold market, this Offering was considerably oversubscribed with the lead order from Palisades Goldcorp Ltd. and orders from several institutions both in Canada and the US and from existing long-term shareholders. We are well-positioned to enhance our growth and are excited to continue to build value for our enlarged shareholder base.”

Each Subscription Receipt will, upon completion of the Company’s Change of Business (as defined below) and certain other customary conditions for a transaction of this nature, be automatically exercised into one unit of the Company (each, a “Unit”). Each Unit will be comprised of one (1) common share in the capital of the Company (each, a “Share”) and one (1) Share purchase warrant (each, a “Warrant”), with each Warrant entitling the holder thereof to purchase one Share at a price of $0.35 for a period of 36 months following the date of closing of the Offering (the "Closing Date").

Subscriptions by insiders of the Company accounted for $104,699.98 of the gross proceeds of the Offering. Participation by insiders in the Offering is exempt from the valuation and minority shareholder approval requirements of Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions by virtue of the exemptions contained in Sections 5.5(b) and 5.7(1)(b).

As previously announced by TRU on February 24, 2021, the Company has entered into an option agreement dated February 23, 2021 with a subsidiary of TSX-listed Altius Minerals Corporation (“Altius”) for the option to purchase the Golden Rose Project located in the Central Newfoundland Gold Belt, which transaction will constitute a Change of Business (the “Change of Business”) under the policies of the Exchange.

The net proceeds from the Offering will be used by the Company to fund its comprehensive exploration program on the Golden Rose Project; a limited phase one drilling program at the Company’s 100%-owned Twilite Gold Project, also in the Central Newfoundland Gold Belt; for general corporate and public company purposes, including hiring additional technical personnel and conducting various marketing initiatives; and to add to working capital for the operations of the Company.

The Subscription Receipts issued in the Offering, and the underlying Units, Shares, and Warrants, will be subject to a statutory hold period expiring July 5, 2021.

Upon completion of the Change of Business, eligible finders will receive, on account of gross proceeds raised from subscribers to the Offering who were introduced by such finders, (a) a cash commission equal to an aggregate of $112,696.61, and (b) an aggregate of 526,257 non-transferrable finder warrants, each of which will entitle the holder thereof to purchase one Share at a price of $0.22 for a period of 36 months following the Closing Date.

The securities issued pursuant to the Offering have not been, and will not be, registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”), or any U.S. state securities laws and may not be offered or sold in the United States absent registration or an available exemption from the registration requirement of the U.S. Securities Act and applicable U.S. state securities laws. This press release shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of, such securities in any jurisdiction in which such offer, solicitation or sale would be unlawful.

About TRU Precious Metals Corp.

TRU has assembled a portfolio of 5 gold exploration properties in the highly prospective Central Newfoundland Gold Belt. The Company has entered into a definitive option agreement with a subsidiary of TSX-listed Altius Minerals Corporation for the option to purchase 100% of the Golden Rose Project, located along the deposit-bearing Cape Ray – Valentine Lake Shear Zone. TRU also owns 100% of the Twilite Gold Project, located along the same Shear Zone, and 3 under-explored properties including its Rolling Pond Property (under option) bordering New Found Gold Corp.’s high-grade Queensway Project. TRU’s common shares trade on the TSX Venture Exchange under the symbol “TRU” and on the OTCQB Venture Market under the symbol “TRUIF”.

TRU is a portfolio company of Resurgent Capital Corp. (“Resurgent”), a merchant bank providing venture capital markets advisory services and proprietary financing. Resurgent works with promising public and pre-public micro-capitalization Canadian companies. For more information on Resurgent and its portfolio companies, please visit Resurgent’s LinkedIn profile at https://ca.linkedin.com/company/resurgent-capital-corp.

About Palisades Goldcorp Ltd.

Palisades Goldcorp is Canada’s resource focused merchant bank. Palisades’ management team has a demonstrated track record of making money and is backed by many of the industry’s most notable financiers. With junior resource equities valued at generational lows, management believes the sector is on the cusp of a major bull market move. Palisades is positioning itself with significant stakes in undervalued companies and assets with the goal of generating superior returns.

For further information, please contact:

Joel Freudman

Co-Founder, President & CEO

TRU Precious Metals Corp.

Phone: (647) 880-6414

Email: info@trupreciousmetals.com

Website: www.trupreciousmetals.com

To connect with TRU via social media, below are links:

Facebook

https://www.facebook.com/TRU-Precious-Metals-Corp-100919195193616

Twitter

https://twitter.com/corp_tru

LinkedIn

https://www.linkedin.com/company/tru-precious-metals-corp

YouTube

https://www.youtube.com/channel/UCHghHMDQaYgS1rDHiZIeLUg/

Cautionary Statements

Completion of the transactions contemplated herein is subject to a number of conditions, including but not limited to Exchange acceptance and, if applicable, disinterested shareholder approval. Where applicable, the transactions cannot close until the required shareholder approval is obtained. There can be no assurance that the transactions will be completed as proposed or at all.

Investors are cautioned that, except as disclosed in the filing statement to be prepared in connection with the transaction, any information released or received with respect to the Change of Business may not be accurate or complete and should not be relied upon. Trading in the securities of the Company should be considered highly speculative.

The Exchange has in no way passed upon the merits of the proposed transaction and has neither approved nor disapproved the contents of this press release. Neither the Exchange nor its Regulation Services Provider (as that term is defined in policies of the Exchange) accepts responsibility for the adequacy or accuracy of this release.

The links included in this press release are included as inactive textual reference for reference purposes only and the information on or connected to those websites are not part of, or incorporated by reference into, this press release.

This press release contains certain forward-looking statements, including those relating to the Offering and the anticipated use of proceeds thereof, the Change of Business, the Company’s transaction with Altius for the Golden Rose Project and the Company’s plans regarding acquiring, exploring, and monetizing the Golden Rose Project and the Company’s other mineral exploration properties. These statements are based on numerous assumptions regarding the Offering, the Golden Rose Project, the transaction with Altius and the Change of Business that are believed by management to be reasonable in the circumstances, and are subject to a number of risks and uncertainties, including without limitation: risks related to the ability of the Company to satisfy the conditions of the Change of Business, and to close the Change of Business; the ability of the Company to accomplish its plans and objectives with respect to its exploration projects, within the expected timing or at all; challenges in identifying, structuring, and executing transactions on favourable terms or at all; risks inherent in mineral exploration activities; volatility in financial markets, economic conditions, and precious metals prices; and those other risks described in the Company’s continuous disclosure documents. Actual results may differ materially from results contemplated by the forward-looking statements herein. Investors and others should carefully consider the foregoing factors and should not place undue reliance on such forward-looking statements. The Company does not undertake to update any forward-looking statements herein except as required by applicable securities laws.

TRU Precious Metals announces oversubscribed private placement of subscription receipts with a lead order from Palisades Goldcorp

Fredericton, New Brunswick – March 1, 2021 – Further to its press release dated February 16, 2021, TRU Precious Metals Corp. (TSXV:TRU; OTCQB:TRUIF) (“TRU” or the “Company”) is pleased to announce that it is upsizing its non-brokered private placement (the “Offering”) due to strong investor demand.

THIS NEWS RELEASE IS NOT INTENDED FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

Fredericton, New Brunswick – March 1, 2021 – Further to its press release dated February 16, 2021, TRU Precious Metals Corp. (TSXV:TRU; OTCQB:TRUIF) (“TRU” or the “Company”) is pleased to announce that it is upsizing its non-brokered private placement (the “Offering”) due to strong investor demand. The Company now anticipates that the Offering will be completed for gross proceeds of not less than $2,500,000, consisting of not less than 11,363,637 subscription receipts (the "Subscription Receipts") at a price of $0.22 per Subscription Receipt, subject to TSX Venture Exchange (the “Exchange”) approval, with a lead order from Palisades Goldcorp Ltd. (“Palisades”).

TRU Co-Founder and CEO Joel Freudman commented: “We are very pleased with the significant demand we are seeing for the Offering. TRU anticipates participation from several institutional investors, including the lead order from Palisades, and retail brokerages, as well as existing shareholders and members of management and the board of directors. As a result, TRU determined to upsize the Offering with a view to fully funding its near-term exploration plans for the Golden Rose Project, among other initiatives to build shareholder value.”

Each Subscription Receipt will, upon completion of the Company's Change of Business (as defined below) and certain other customary conditions for a transaction of this nature, be automatically exercised into one unit of the Company (each, a “Unit”). Each Unit will be comprised of one (1) common share in the capital of the Company (each, a “Share”) and one (1) Share purchase warrant (each, a “Warrant”), with each Warrant entitling the holder thereof to purchase one Share at a price of $0.35 for a period of 36 months following the date of closing of the Offering (the "Closing Date"), scheduled for March 4, 2021.

As previously announced by TRU on February 24, 2021, the Company has entered into an option agreement dated February 23, 2021 with a subsidiary of TSX-listed Altius Minerals Corporation (“Altius”) for the option to purchase the Golden Rose Project located in the Central Newfoundland Gold Belt, which transaction will constitute a Change of Business (the “Change of Business”) under the policies of the Exchange.

The net proceeds from the Offering will be used by the Company to fund its comprehensive exploration program on the Golden Rose Project; a limited phase one drilling program at the Company’s 100%-owned Twilite Gold Project, also in the Central Newfoundland Gold Belt; for general corporate and public company purposes, including hiring additional technical personnel and conducting various marketing initiatives; and to add to working capital for the operations of the Company. The Company has received conditional approval from the Exchange for the Offering for maximum gross proceeds of up to $3,500,000.

The Subscription Receipts issued in the Offering, and the underlying Units, Shares, and Warrants, will be subject to a hold period of four months and one day from the Closing Date.

Upon completion of the Change of Business, eligible finders will receive (a) a cash commission equal to 7% of the gross proceeds raised from subscribers to the Offering who were introduced by such finder, and (b) such number of non-transferrable finder warrants (“Finder Warrants”) as is equivalent to 7% of the number of Subscription Receipts issued to such subscribers. Each Finder Warrant will entitle the holder thereof to purchase one Share at a price of $0.22 for a period of 36 months following the Closing Date.

In addition, the Company announces that it has entered into a second amendment agreement (the “Second Amendment”) to the loan (the “Loan”) previously advanced by the Company to Revive Organics Inc. (“Revive Superfoods”), as set out in the Company’s press release dated March 20, 2020. The Loan is a legacy investment made by the Company that is being fully repaid in connection with the Company’s Change of Business. Pursuant to the Second Amendment, the payment schedule for the Loan has been updated as follows, inclusive of interest: $100,000 due on March 5, 2021; $336,250 due on March 31, 2021; $223,500 due on April 30, 2021; and $201,667 due on May 31, 2021. As consideration for entering into the Second Amendment, Revive Superfoods will also pay the Company a one-time fee of $21,000 on May 31, 2021.

About TRU Precious Metals Corp.

TRU has assembled a portfolio of 5 gold exploration properties in the highly prospective Central Newfoundland Gold Belt. The Company has entered into a definitive option agreement with a subsidiary of TSX-listed Altius Minerals Corporation for the option to purchase 100% of the Golden Rose Project, located along the deposit-bearing Cape Ray – Valentine Lake Shear Zone. TRU also owns 100% of the Twilite Gold Project, located along the same Shear Zone, and 3 under-explored properties including its Rolling Pond Property (under option) bordering New Found Gold Corp.’s high-grade Queensway Project. TRU’s common shares trade on the TSX Venture Exchange under the symbol “TRU” and on the OTCQB Venture Market under the symbol “TRUIF”.

TRU is a portfolio company of Resurgent Capital Corp. (“Resurgent”), a merchant bank providing venture capital markets advisory services and proprietary financing. Resurgent works with promising public and pre-public micro-capitalization Canadian companies. For more information on Resurgent and its portfolio companies, please visit Resurgent’s LinkedIn profile at https://ca.linkedin.com/company/resurgent-capital-corp.

For further information, please contact:

Joel Freudman

Co-Founder, President & CEO

TRU Precious Metals Corp.

Phone: (647) 880-6414

Email: info@trupreciousmetals.com

Website: www.trupreciousmetals.com

To connect with TRU via social media, below are links:

Facebook

https://www.facebook.com/TRU-Precious-Metals-Corp-100919195193616

Twitter

https://twitter.com/corp_tru

LinkedIn

https://www.linkedin.com/company/tru-precious-metals-corp

YouTube

https://www.youtube.com/channel/UCHghHMDQaYgS1rDHiZIeLUg/

Cautionary Statements

Completion of the transactions contemplated herein is subject to a number of conditions, including but not limited to Exchange acceptance and, if applicable, disinterested shareholder approval. Where applicable, the transactions cannot close until the required shareholder approval is obtained. There can be no assurance that the transactions will be completed as proposed or at all.

Investors are cautioned that, except as disclosed in the filing statement to be prepared in connection with the transaction, any information released or received with respect to the Change of Business may not be accurate or complete and should not be relied upon. Trading in the securities of the Company should be considered highly speculative.

The Exchange has in no way passed upon the merits of the proposed transaction and has neither approved nor disapproved the contents of this press release. Neither the Exchange nor its Regulation Services Provider (as that term is defined in policies of the Exchange) accepts responsibility for the adequacy or accuracy of this release.

The links included in this press release are included as inactive textual reference for reference purposes only and the information on or connected to those websites are not part of, or incorporated by reference into, this press release.

This press release contains certain forward-looking statements, including those relating to the Offering and the anticipated closing date and use of proceeds thereof, the Change of Business, the Company's transaction with Altius for the Golden Rose Project, the Company's plans regarding acquiring, exploring, and monetizing the Golden Rose Project and the Company’s other mineral exploration properties, and the timing of repayment of the Loan. These statements are based on numerous assumptions regarding the Offering, the Golden Rose Project, the transaction with Altius, the Change of Business and the Loan that are believed by management to be reasonable in the circumstances, and are subject to a number of risks and uncertainties, including without limitation: risks related to the ability of the Company to satisfy the conditions of the Offering and the Change of Business, and to close the Offering and subsequently the Change of Business; the ability of the Company to accomplish its plans and objectives with respect to its exploration projects, within the expected timing or at all; challenges in identifying, structuring, and executing transactions on favourable terms or at all; risks inherent in mineral exploration activities; Loan repayment risk; volatility in financial markets, economic conditions, and precious metals prices; and those other risks described in the Company’s continuous disclosure documents. Actual results may differ materially from results contemplated by the forward-looking statements herein. Investors and others should carefully consider the foregoing factors and should not place undue reliance on such forward-looking statements. The Company does not undertake to update any forward-looking statements herein except as required by applicable securities laws.

TRU Precious Metals engages Momentum and MI3 for Québec Investor Relations

Fredericton, New Brunswick – February 25, 2021 – TRU Precious Metals Corp. (TSXV: TRU) (OTCQB: TRUIF) (“TRU” or the “Company”) is pleased to announce that, subject to regulatory approval by the TSX Venture Exchange (the “TSXV”), it has engaged Momentum Public Relations Inc. (“Momentum”) and MI3 Communications Financières Inc. (“MI3”) to spearhead the Company’s investor relations efforts predominantly in the province of Québec.

Fredericton, New Brunswick – February 25, 2021 – TRU Precious Metals Corp. (TSXV: TRU) (OTCQB: TRUIF) (“TRU” or the “Company”) is pleased to announce that, subject to regulatory approval by the TSX Venture Exchange (the “TSXV”), it has engaged Momentum Public Relations Inc. (“Momentum”) and MI3 Communications Financières Inc. (“MI3”) to spearhead the Company’s investor relations efforts predominantly in the province of Québec.

Momentum will assist the Company by facilitating dialogues with investors and stockbrokers, and by advising the Company on various financing alternatives. As consideration for these services, the Company has agreed to pay Momentum a monthly cash fee of CAD$9,200, for a 6-month term scheduled to commence on April 1, 2021. The Company has also agreed that, following completion of its TSXV Change of Business (as such term is defined in TSXV policies) and resumption of trading of the Company’s shares on the TSXV, it will grant Momentum 450,000 incentive stock options (“Options”) on terms to be determined by TRU’s board of directors (the “Board”) and in accordance with the Company’s stock option plan (the “SOP”) and TSXV policies.

MI3 will provide the Company with a wide range of publicity and investor relations services, including conducting targeted communications campaigns following notable developments about the Company, and arranging virtual introductions to and roadshows with stockbrokers and high-net-worth individuals. As consideration for these services, the Company has agreed to pay MI3 a monthly cash fee of CAD$5,000, for an initial 6-month term scheduled to commence on April 1, 2021. The Company has also agreed that, following completion of its TSXV Change of Business and resumption of trading of the Company’s shares on the TSXV, it will grant MI3 100,000 Options on terms to be determined by the Board and in accordance with the SOP and TSXV policies.

Each of Momentum and MI3 act at arm’s length to TRU and do not currently have any interest, directly or indirectly, in the Company or its securities. Each of Momentum and MI3 intends to acquire securities of TRU in the future.

About Momentum Public Relations Inc.

Momentum is a Montréal-based public relations and investor relations firm that assists public companies in distributing their messaging to target audiences within the North American investment community. Through a national network of institutional investors, analysts and financial media relationships, the team communicates each client’s value drivers, growth potential and developmental vision clearly and efficiently. The experienced team of communications specialists works closely with senior management of each client to build publicity campaigns while executing on a long-term investor relations strategy that remains flexible to respond to immediate changes. Momentum’s address is Suite 109 - 50 La Barre Street, Longueuil, Québec, J4K 5G2. For further information about Momentum, please visit https://momentumpr.com/.

About MI3 Communications Financières Inc.

Launched in 2007, MI3 is a Montréal-based financial communications and investor relations firm geared for today’s fast-paced global economy. MI3’s services were developed to leverage the trading and market experience of its bilingual team to provide public relations, market-making activities and investor relations to Canadian public companies. MI3’s address is Suite 402 - 590 Jacques Lavigne, Ste-Thérèse, Québec, J7E 0A8. For further information about MI3, please visit http://mi3.ca/.

About TRU Precious Metals Corp.

TRU has assembled a portfolio of 5 gold exploration properties in the highly prospective Central Newfoundland Gold Belt. The Company has entered into a definitive option agreement with a subsidiary of TSX-listed Altius Minerals Corporation for the option to purchase 100% of the Golden Rose Project, located along the deposit-bearing Cape Ray – Valentine Lake Shear Zone. TRU also owns 100% of the Twilite Gold Project, located along the same Shear Zone, and 3 under-explored properties including its Rolling Pond Property (under option) bordering New Found Gold Corp.’s high-grade Queensway Project. TRU’s common shares trade on the TSX Venture Exchange under the symbol “TRU” and on the OTCQB Venture Market under the symbol “TRUIF”.

TRU is a portfolio company of Resurgent Capital Corp. (“Resurgent”), a merchant bank providing venture capital markets advisory services and proprietary financing. Resurgent works with promising public and pre-public micro-capitalization Canadian companies. For more information on Resurgent and its portfolio companies, please visit Resurgent’s LinkedIn profile at https://ca.linkedin.com/company/resurgent-capital-corp.

For further information, please contact:

Joel Freudman

Co-Founder, President & CEO

TRU Precious Metals Corp.

Phone: (647) 880-6414

Email: info@trupreciousmetals.com

Website: www.trupreciousmetals.com

To connect with TRU via social media, below are links:

Facebook

https://www.facebook.com/TRU-Precious-Metals-Corp-100919195193616

Twitter

https://twitter.com/corp_tru

LinkedIn

https://www.linkedin.com/company/tru-precious-metals-corp

YouTube

https://www.youtube.com/channel/UCHghHMDQaYgS1rDHiZIeLUg/

Cautionary Statements

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This press release contains certain forward-looking statements, including those relating to regulatory approval and the Company’s ongoing relationships with Momentum and MI3. These statements are based on numerous assumptions regarding the Company’s corporate and investor relations strategies that are believed by management to be reasonable in the circumstances, and are subject to a number of risks and uncertainties, including without limitation: regulatory approval processes; challenges in attracting and retaining qualified personnel; volatility in financial markets, economic conditions, and precious metals prices; and those other risks described in the Company’s continuous disclosure documents. Actual results may differ materially from results contemplated by the forward-looking statements herein. Investors and others should carefully consider the foregoing factors and should not place undue reliance on such forward-looking statements. The Company does not undertake to update any forward-looking statements herein except as required by applicable securities laws.

TRU Precious Metals Signs Definitive Option Agreement with Subsidiary of Altius Minerals to Purchase Golden Rose Project

Fredericton, New Brunswick – February 24, 2021 – TRU Precious Metals Corp. (TSXV:TRU; OTCQB:TRUIF) (“TRU” or the “Company”) is pleased to announce that it has signed a definitive option agreement dated February 23, 2021 (the “Option Agreement”) with a subsidiary of TSX-listed Altius Minerals Corporation (TSX:ALS) (“Altius”) to purchase Altius’ Golden Rose Project (as defined below).

Fredericton, New Brunswick – February 24, 2021 – TRU Precious Metals Corp. (TSXV:TRU; OTCQB:TRUIF) (“TRU” or the “Company”) is pleased to announce that it has signed a definitive option agreement dated February 23, 2021 (the “Option Agreement”) with a subsidiary of TSX-listed Altius Minerals Corporation (TSX:ALS) (“Altius”) to purchase Altius’ Golden Rose Project (as defined below). This is further to the Company’s press releases dated January 7, 2021 and February 2, 2021.

TRU Co-Founder and CEO Joel Freudman commented: “We are excited by the prospects of this historically explored property. Golden Rose is ideally located along the deposit-bearing Cape Ray – Valentine Lake Shear Zone, with highway access, in a mining-friendly jurisdiction. We believe that the long-term prospects for gold are very robust and as such we could not ignore the opportunity that we feel the Golden Rose Project represents. In addition, upon closing of this transaction, we will be delighted to welcome Altius to TRU’s shareholder base as a strategic investor, holding an approximate 19.9% stake.”

Golden Rose Project

The Golden Rose Project is a regional-scale land package covering 105 km2 within the Valentine Lake structural corridor, and is easily accessible via provincial highway and forest access roads. It is located between Marathon Gold Corp.’s Valentine Gold Project to the northeast and Matador Mining Ltd.’s Cape Ray Gold Project to the southwest.

Figure 1: Golden Rose Project Regional Location

A technical description of the Golden Rose Project is available in the Company’s press release dated January 7, 2021.

Terms of the Option Agreement

TRU has entered into the Option Agreement, by which Altius grants to TRU the exclusive right and option (the “Option”) to acquire, subject to retention by Altius of a maximum 2.0% net smelter return (“NSR”) royalty, its 100% interest in a package of mineral claims located in the southwestern portion of the Central Newfoundland Gold Belt (the “Altius Claims”). Altius has also agreed to assign an existing option agreement (the “Rose Gold Agreement”, and together with the Option Agreement, collectively, the “Transaction”) under which Shawn Rose (the “Rose Optionor”) has granted the exclusive right and option to acquire, subject to retention by the Rose Optionor of a royalty, his 100% interest in certain surrounding mineral claims known as the Rose Gold claims (the “Rose Gold Claims”). Collectively, the Altius Claims and the Rose Gold Claims, as well as any future claims added within a defined area of interest around the Rose Gold Claims and the Altius Claims, will be called the “Golden Rose Project”.

In order to acquire a 100% interest in the Golden Rose Project, the Company must issue such number of common shares in the capital of TRU (“TRU Shares”) as set forth below, and fund a total of $3,000,000 in exploration expenditures:

| Date | TRU Share Issuance | Exploration Funding Commitment |

|---|---|---|

| Closing Date ("Closing Date") of the Option Agreement |

7,140,000 TRU Shares, at a deemed price of $0.25 per TRU share |

Nil |

| By one (1) month from the Closing Date |

800,000 TRU shares, at a deemed price of $0.25 per TRU share |

Nil |

| By February 23, 2022 | 800,000 TRU Shares, at a deemed price of $0.25 per TRU Share |

$500,000 |

| By February 23, 2023 | 1,400,000 TRU Shares, at a deemed [price of $0.25 per TRU share |

An additional $1,000,000 |

| By February 23, 2024 | Nil | An additional $1,500,000 |

Notwithstanding the foregoing, the Option Agreement provides that on any given TRU Share issuance date only that number of TRU Shares will be issued which will result in the total shareholdings of Altius not exceeding 19.9% percent of the issued and outstanding TRU Shares as of the date of the issuance (provided such TRU Shares shall remain issuable by TRU prior to full exercise of the Option).

In addition, TRU must pay the Rose Optionor: (i) $22,500, in cash or by issuance of TRU Shares, at the election of the Rose Optionor, on November 30, 2021; and (ii) $37,500, in cash or by issuance of TRU Shares, at the election of the Rose Optionor, on November 30, 2022. The deemed value of such TRU Shares, if issued in lieu of cash, shall be the greater of (a) $0.25 per TRU Share and (b) the closing price of such TRU Shares on the TSX Venture Exchange (the “Exchange”), on the day prior to such payment date.

TRU will also have to pay the Rose Optionor a $250,000 cash bonus if TRU defines at least 1,000,000 ounces of gold on the Rose Gold Claims in the Measured & Indicated categories of a National Instrument 43-101 mineral resource estimate. TRU shall also grant the Rose Optionor a 2.0% NSR on any future mineral production at the Rose Gold Claims.

Upon TRU fulfilling the initial issuance of TRU Shares under the Option Agreement, Altius is expected to have an approximately 19.9% ownership interest in TRU, based on the current number of issued and outstanding TRU Shares. Altius also has a right to participate in future financings by TRU in order to maintain its ownership interest up to a maximum of 19.9%. Neither Altius nor the Rose Optionor is a Non-Arm’s Length Party (as such term is defined in Exchange Policy 1.1) to the Company, nor is the Rose Optionor a Non-Arm’s Length Party to Altius, and as such the Transaction is an Arm’s Length Transaction (as such term is defined in Exchange Policy 1.1).

Upon exercise of the Option, Altius will retain the NSR from any future mineral production at the Golden Rose Project, subject to a reduction for any underlying royalty obligations held by third parties, including the royalty retained by the Rose Optionor.

Pursuant to the Option Agreement, the completion of the Transaction is subject to a number of conditions including, among others: (i) conditional approval of the Exchange in respect of the Transaction and the listing of the TRU Shares to be issued pursuant thereto; (ii) requisite approval by the shareholders of the Company; (iii) Altius being the registered and beneficial owner of a 100% interest in the Golden Rose Project free and clear of all encumbrances, subject to as provided in the Rose Gold Agreement; (iv) TRU adding not less than $3,000,000 of gross cash proceeds from equity financing activities and property-level transactions by February 23, 2023; and (v) no material adverse change having occurred with respect to the Company or the Golden Rose Project. The TRU Shares are expected to remain halted from trading until on or shortly after the Closing Date.

Qualified Person

Barry Greene, P.Geo. is a qualified person as defined by National Instrument 43-101 and has reviewed and approved the contents and technical disclosures in this press release. Mr. Greene is a director and officer of the Company and owns securities of the Company.

About TRU Precious Metals Corp.